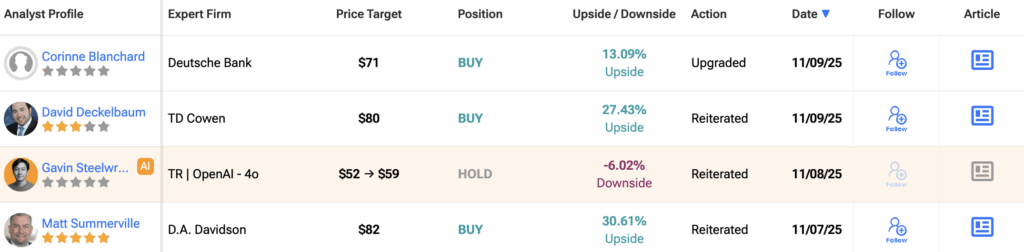

MP Materials (MP) just got another vote of confidence. Deutsche Bank’s Corinne Blanchard upgraded the stock to Buy from Hold and lifted her target to $71 from $68. In her note, she wrote, “We believe MP now represents a buying opportunity for investors wanting to have exposure to the thematic of critical minerals and Rare Earth on the medium to long-term.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The market leaned in. MP shares were up about 2.9% premarket to $60.32 after a 12.8% jump on Friday, which followed better-than-expected third-quarter results. It is a quick tone shift after a bruising month that left the stock down 25%, even though MP is still up roughly 276% in 2025.

MP’s Earnings Reset Expectations

Last week’s report reminded investors that fundamentals are improving. Revenue and profitability cleared a low bar, easing fears that weak pricing would overwhelm execution. Stock gains into the weekend suggest investors see the print as a reset rather than a one-off.

Blanchard values MP at 18× projected 2028 EBITDA, a framework that anchors a multi-year view. FactSet shows Street models calling for EBITDA to rise from about $245 million in 2026 to roughly $520 million by 2028. That path would support the bank’s $71 target and helps explain why dip buyers showed up.

Policy Support Strengthens the Case

Washington continues to play a role. In July, the Defense Department struck a deal with MP that included an equity investment, a price floor, and a guaranteed customer for magnets the company is building facilities to produce. That package reduces revenue uncertainty and signals strategic backing.

Policy tailwinds are important because China controls about 85% of global rare-earth processing capacity. Headlines around potential export restrictions rattled the group in October. Once fears eased, prices did too. Investors are now re-focusing on who can produce at scale inside the West, and MP still sits alone as a fully integrated operator.

MP’s Upgrade Lifts Its Peers

Strength in MP helped peers open higher. USA Rare Earth (USAR) and Ramaco Resources (METC) ticked up in early trading after rough stretches that saw both names slide 47% and 48% over the past month, respectively. Even with those drawdowns, USA Rare Earth is up 51% in 2025 and Ramaco is up 160%.

Sector beta cuts both ways. When geopolitical risk cools, the entire basket can deflate. When sentiment returns, liquidity flows back into the leaders first, and that often pulls up the rest. Monday’s action fit that playbook.

What to Watch Next

Track magnet facility milestones, unit cost trends, and any updates on the Defense Department arrangement. Pricing signals from China will continue to sway sentiment.

At the moment, the upgrade gives bulls fresh cover, earnings cleared a near-term hurdle, and policy backing remains intact. This combination of factors is why MP is climbing again, and why rare-earth stocks across the board are catching a lift.

Is MP Materials Stock a Good Buy?

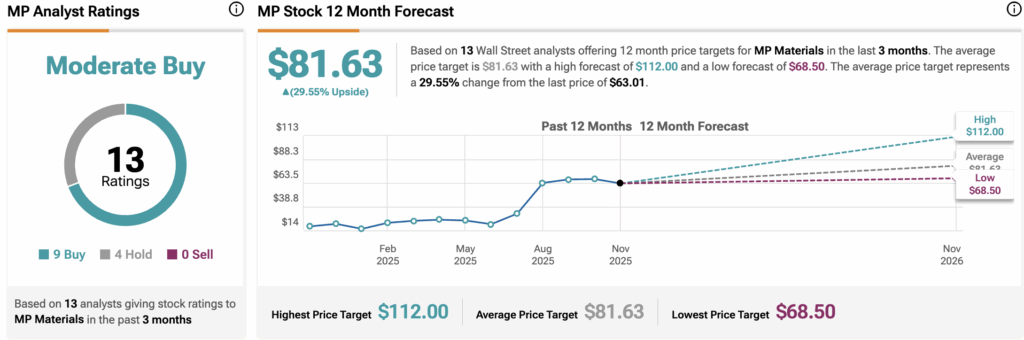

Coverage remains supportive. TipRanks’ analyst data paints a moderately bullish picture for the stock’s next leg. Based on 13 Wall Street analysts, MP holds a “Moderate Buy” consensus, with nine Buy ratings and four Holds issued in the past three months.

The group’s average 12-month MP price target stands at $81.63, implying roughly 30% upside from the current price.

Investors should remember why MP stock slid: a sharp rally into mid-October, followed by China headlines and profit taking. If pricing stabilizes and U.S. policy support holds, the long-only thesis leans on execution and magnet ramp progress rather than momentum alone.