Neodymium-iron-boron (NdFeB) magnets play a critical role in infrastructure and defense. However, the heavy reliance on imports, mainly from China, presents a significant national security concern for the U.S. MP Materials (NYSE: MP) holds a strategic position as the only scaled rare earth mine and separations facility in the U.S., positioning it for substantial growth. Though the stock has been down over the past year, it presents a compelling opportunity for long-term investors seeking exposure to the rare earth metals market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Rare Earth Mining

MP Materials is one of the largest producers of rare earth materials, accounting for approximately 15% of the world’s supply. The rare earth materials produced play a vital role in powering a wide range of advanced technologies, including electric vehicles, drones, and wind turbines.

In addition to its mining operations, MP Materials produces NdPr oxide at its Mountain Pass facility. NdPr (Neodymium-Praseodymium) oxide is a rare earth metal compound primarily utilized in the manufacturing of permanent magnets.

The global market demand for magnet rare earth oxide is forecast to increase five-fold by 2040 to over $57b.

Financial Outlook

MP Materials recently announced Q4 financial results, revealing a fourth-quarter loss, primarily caused by decreased prices for strategic minerals and rising production costs. Nevertheless, the reported loss was less severe than what analysts had predicted. The company posted Q4 adjusted EPS at -$0.02, compared to the consensus estimate of -$0.04, and reported Q4 revenue of $52.21M, surpassing the consensus of $45.73M.

MP ended the year with just under $1 billion of gross cash and over $300 million of net cash. The company expects to spend between approximately $200 million and $250 million on total CapEx, though, at current spot prices, it is still forecasting to end 2024 with greater than $900 million of gross cash and $200 to $250 million of net cash on the balance sheet.

The company also announced that its Board of Directors had given the green light for a share repurchase program worth up to $300 million of its common stock. This strategic move aims to create additional value for shareholders. The program is applicable for one year and does not commit to purchasing a specific minimum number of shares.

What is the Price Target for MP?

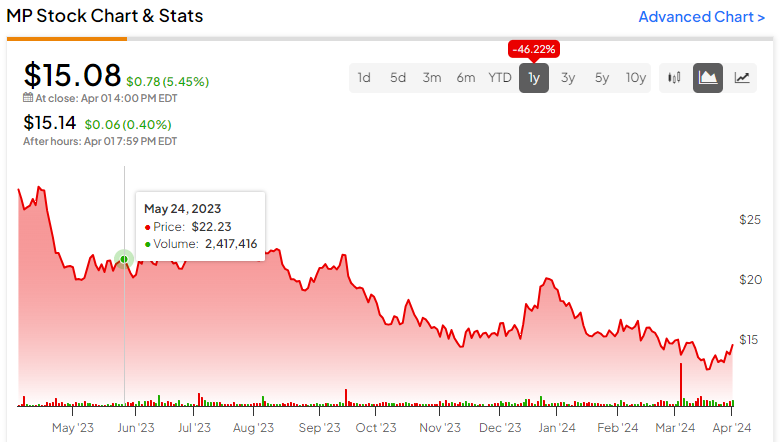

The MP Materials stock has been trending down, posting a -46.22% return over the past year. It is trading at the low end of its 52-week price range of $12.68-$28.75 and continues to show negative price momentum. Based on various relative metrics (P/E, P/S, EV/EBITDA), the stock looks fair-to-overvalued, though if the price continues to slide, it could quickly enter value territory.

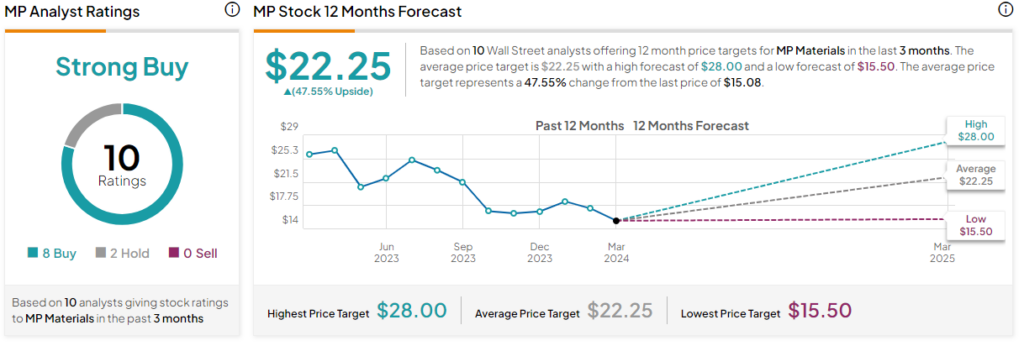

Analysts following the stock are cautiously optimistic. For example, BofA analyst Lawson Winder recently reduced the price target for MP Materials from $30 to $25 while maintaining a Buy rating on the shares. He cites near-term price weakness in NdPr, though he sees prices bottoming in Q1 with a positive medium- to long-term outlook driving profits.

The MP stock is rated a Strong Buy based on the ratings and 12-month price targets of ten Wall Street analysts who have published in the past three months. The average price target for MP stock is $22.25, which represents a 47.55% upside from current levels.

Final Analysis on MP Materials

MP Materials, the only operational rare earth mine and separations facility in the U.S., is poised to benefit from rising global demand for these crucial resources. Despite a minor setback with a Q4 loss, the company’s financial outlook remains promising. Its robust cash position and strategic initiatives, like a $300 million share repurchase program, underscore its investment value.

As the demand for rare earth materials is set to explode in the coming years, MP Materials is well-positioned for potential growth, making it a compelling long-term investment.