EV major Tesla (NASDAQ: TSLA) was on an upswing in pre-market trading on Monday after top-rated Morgan Stanley analyst Adam Jonas upgraded the stock to a Buy from a Hold and gave a “top pick” designation to the stock. Jonas also raised the price target to $400 from $250 on the stock. The analyst’s price target is the highest on the Street and implies an upside potential of around 61% at current levels. Jonas’ price target implies a market capitalization of around $1.39 trillion for the EV giant.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The explanation for Jonas’ bullish stance on TSLA stems from its Dojo supercomputer that could open up new markets for the company that “extend well beyond selling vehicles at a fixed price.” By the analyst’s estimate, the total addressable market for the supercomputer could be $10 trillion.

The analyst commented, “If Dojo can help make cars ‘see’ and ‘react,’ what other markets could open up? Think of any device at the edge with a camera that makes real-time decisions based on its visual field.”

Tesla has started production of Dojo, which will be used to train artificial intelligence (AI) models for self-driving cars in July, and intends to spend in excess of $1 billion on Dojo through next year.

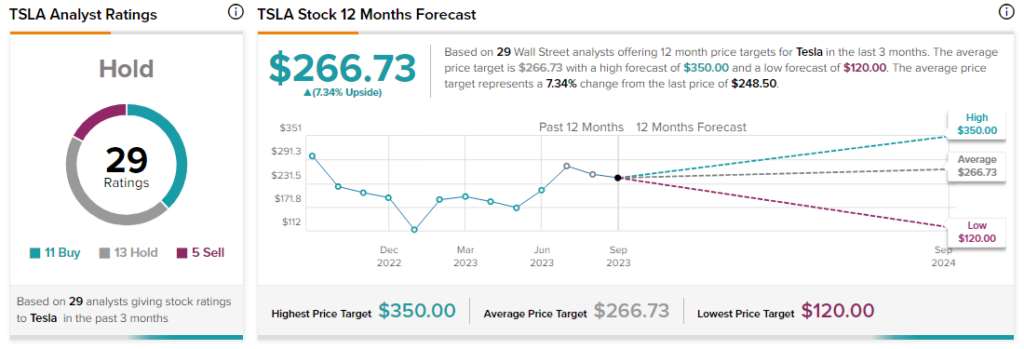

Besides Jonas, other analysts, however, remain sidelined about TSLA stock with a Hold consensus rating based on 11 Buys, 13 Holds and five Sells.