As evidenced by Tesla’s (NASDAQ:TSLA) latest disastrous quarterly readouts, the EV leader has been facing a demand issue. Slashing prices has only helped so much, and its vehicle lineup appears dated and could use a refresh. The anticipated mass-market Model 2 is expected to tackle these issues. Then again, perhaps not.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

On Friday, based on information from various sources and internal company messages, Reuters reported that Tesla has decided to pause work on its affordable car initiative to focus on advancing its robotaxis. CEO Elon Musk was quick to offer a denial in customary style, responding on X that “Reuters is lying (again)” although that’s all the details Tesla have offered on the matter so far. On the other hand, later on Friday, Musk posted on X that the Tesla Robotaxi will be unveiled on August 8.

So, another day, another piece of Tesla/Musk drama. While these are two a penny, should the Reuters report turn out to be true, it could have a big impact on the way forward for Tesla.

Morgan Stanley analyst Adam Jonas considers the Model 2 “critical to the medium-term top-line growth narrative.” According to his model, from FY24 through FY30, the Model 2 represents more than 40% “incremental unit volume.” By 2030, the analyst reckons the Model 2 will amount to 36% of Tesla’s unit volume, 23% of auto revenue, 17% of total company revenue and around 10% of overall EBIT.

“While Model 2 may be a small part of the profit pool for Tesla, a pulling back from low-cost/high volume products would be negative to near-term sentiment and is potentially thesis-changing for many bulls,” Jonas said.

Scrapping plans for the Model 2 also raises several questions. Does its mean China is already too far ahead with there being enough strong EV makers in the country able to offer low-cost EVs? Has Tesla come to the conclusion that “even a well-executed Model 2 launch would not be a ‘game changer’”?

As for the robotaxi’s expected unveil, does this boost the FSD (full self-driving) bull case? Not really, says Jonas. “While we do believe Tesla has advantages around developing the computer vision/robotics technologies necessary to be dominant in autonomous driving, we believe a host of legal/regulatory issues will make this journey measured in decades rather than years,” the analyst explained.

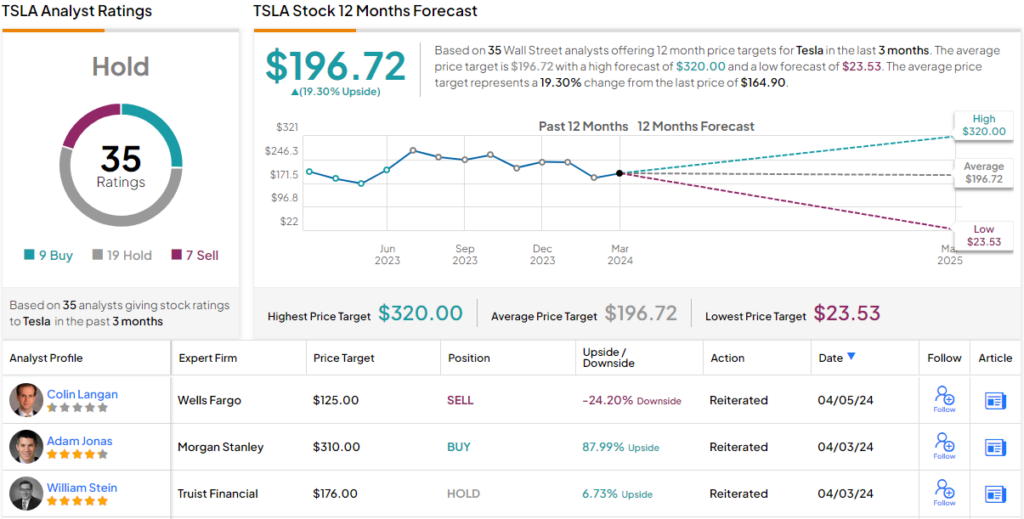

All in, Jonas remains a TSLA bull, reiterating an Overweight (i.e., Buy) rating backed by a $310 price target. If his price target is achieved, investors could realize a potential total return of ~88% (To watch Jonas’s track record, click here)

That is one of the Street’s most bullish takes, but most have a more skeptical bent. Based on 19 Holds, 9 Buys and 7 Sells, the analyst consensus rates the stock a Hold (i.e. Neutral). However, going by the $196.72 average target, a year from now, shares will be changing hands for a 19% premium. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.