There’s a “good news, bad news” situation happening now with Morgan Stanley (NSYE:MS). The company, led by a new CEO, just had a better-than-anticipated first quarter. On the other hand, regulators are investigating Morgan Stanley. Looking at the overall picture, however, I am bullish on MS stock but will also remain alert to ongoing developments.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Morgan Stanley is among the biggest and best-known financial institutions in the U.S. Quarterly earnings seasons typically kick off with big banks like Morgan Stanley reporting first, and this can set the tone for the coming weeks.

As it turns out, the tone is quite positive regarding Morgan Stanley today. This doesn’t mean that Morgan Stanley is completely problem-free, however. So, read on as we uncover the good and the not-so-good developments with this famous financial giant.

Multiple Entities Investigate Morgan Stanley

Last Thursday, April 11, wasn’t such a great day for Morgan Stanley’s shareholders. That’s because MS stock fell 5% due to a Wall Street Journal report that multiple regulatory bodies were investigating Morgan Stanley’s Wealth Management division.

Before we move forward, let’s back up a bit. Last year, the Wall Street Journal reported that the U.S. Federal Reserve was probing Morgan Stanley’s Wealth Management segment due to concerns that the company wasn’t taking sufficient measures to prevent the potential money-laundering activities of affluent foreign Wealth Management clients. That investigation is still ongoing.

Now, three other U.S. government entities are probing the same Wealth Management division. Again, the concerns pertain to whether Morgan Stanley is properly vetting international clients and verifying the origins of their wealth prior to onboarding them as Wealth Management customers.

The outcome of these investigations is crucial since Morgan Stanley’s Wealth Management segment accounted for 48.5% of the company’s revenue in 2023. With Morgan Stanley facing the scrutiny of at least four regulatory entities now, don’t assume that a resolution will happen anytime soon.

For what it’s worth, Morgan Stanley CEO Ted Pick seems calm and collected about this situation. Pick assured, “This is not a new matter. We’ve been focused on our client onboarding and monitoring processes for a good while… We have ongoing communications with our regulators, as all the large banks do.” Nonetheless, investors should keep tabs on this story as it unfolds.

Morgan Stanley CEO Passes the Test, So Far

Pick just took the CEO role at Morgan Stanley in January, and he’s facing an ongoing test as multiple regulators probe the company’s Wealth Management division. However, Pick just faced an immediate test when Morgan Stanley released its first-quarter 2024 financial results.

It’s fair to conclude that Pick and Morgan Stanley passed that test with flying colors. Chris Kotowski of Oppenheimer (whom we’ll mention again in a moment) praised Morgan Stanley’s “near-perfect print” and summarized, “It was an excellent quarter all around.”

I fully concur with Kotowski’s assessment. In Q1 of 2024, Morgan Stanley generated revenue of $15.1 billion, up 4.1% year-over-year and above the consensus estimate of $14.4 billion.

Turning to the bottom-line results, Morgan Stanley’s quarterly earnings of $2.02 per share showed a notable improvement over the year-earlier quarter’s earnings result of $1.70 per share. Furthermore, this result beat the consensus estimate of $1.67 per share.

A notable highlight of the quarter’s results is that Morgan Stanley’s Investment Banking segment revenue rose 16% year-over-year to $1.447 billion. Bear in mind that there was chatter circulating about a possible banking crisis in 2022 and 2023. I won’t assume that everything is perfect in America’s financial sector, but at least Morgan Stanley appears to be on solid footing in early 2024.

So far, it looks like Pick has been, well, a good pick. Morgan Stanley’s board chose the right person for the job, it seems, though the first quarter is only one of many hurdles to clear. Over the coming months, Pick and Morgan Stanley will have to deal with probing regulators and interest rates that could stay higher for longer.

Is Morgan Stanley Stock a Buy, According to Analysts?

On TipRanks, MS comes in as a Moderate Buy based on eight Buys and eight Hold ratings assigned by analysts in the past three months. The average Morgan Stanley stock price target is $98.60, implying 10.6% upside potential.

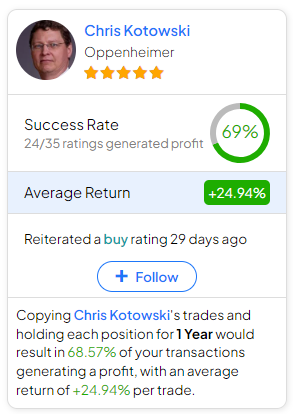

If you’re wondering which analyst you should follow if you want to buy and sell MS stock, the most profitable analyst covering the stock (on a one-year timeframe) is Chris Kotowski of Oppenheimer, with an average return of 24.94% per rating and a 69% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Morgan Stanley Stock?

Kotowski’s positive evaluation of Morgan Stanley’s first quarter of the year is, I believe, spot on. Morgan Stanley’s better-than-expected results reflect well on Pick, and it makes sense that the company’s stock is rising today.

At the same time, investors can’t be complacent. It’s important to monitor the ongoing developments as Morgan Stanley faces probes from more than one regulatory entity. That being said, I remain cautiously bullish on MS stock and may consider a long position today.