UnitedHealth (NYSE:UNH) stock has had a bumpy ride in 2025, marked by underwhelming quarterly results that saw the company first lower and then withdraw its profit guidance. Although it reinstated its outlook following the release of Q2 results, the revised forecast failed to impress Wall Street. More recently, however, investor mood has improved following an update on Medicare Advantage Star ratings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With the healthcare giant slated to report Q3 results tomorrow (October 28) before the open, Morgan Stanley’s Erin Wright, an analyst who ranks among the top 3% on Wall Street, thinks that despite the better mood around the company, UNH still has more to prove.

“While sentiment has improved following recent Stars results and constructive investor meetings at our Conference, execution remains key,” the 5-star analyst said. “Investors will be focused on clean results and credible commentary around Medicare Advantage (MA) margin recovery, operational progress at Optum Health, and early signals on ’26. Management has expressed a clear desire to return to the beat-and-raise cadence that historically defined UNH, and this quarter will be a critical checkpoint in that journey.”

In MA, the company has signaled confidence in a margin recovery, with Wright expecting the pre-tax margin targets of 2.0–2.5% for 2025 and 2.5–3.0% for 2026 to remain unchanged, supported by bid strategies and benefit redesigns that emphasize profitability over growth. The analyst points to the 78.5% of members enrolled in 4+ Star plans, up from roughly 71% a year ago as a “meaningful step toward margin recovery.”

Meanwhile, Optum Health continues to be a key area of investor focus, as management works to resolve operational issues across four main fronts: stabilizing the VBC (value-based care) platform, streamlining care delivery operations, enhancing system consistency, and investing in clinical programs and quality. At an investor dinner last month, Wright notes that new CFO Wayne DeVeydt highlighted the need for stronger integration, acknowledging that past efforts had been “more fragmented.”

As for the outlook for 2026, while it might still be too early for formal 2026 targets, Wright anticipates a “similarly conservative approach” as seen in 2025. The analyst’s model has 2026 EPS growth of about 9.4% year-over-year, and views a range of roughly 6–9% (consensus is at 8.5%) as a “reasonably conservative bar.”

“We remain constructive heading into the print,” Wright summed up, highlighting UNH’s “improving Stars trajectory, operational reset at Optum Health, and commitment to disciplined execution,” as reasons behind her Overweight (i.e., Buy) rating. (To watch Wright’s track record, click here)

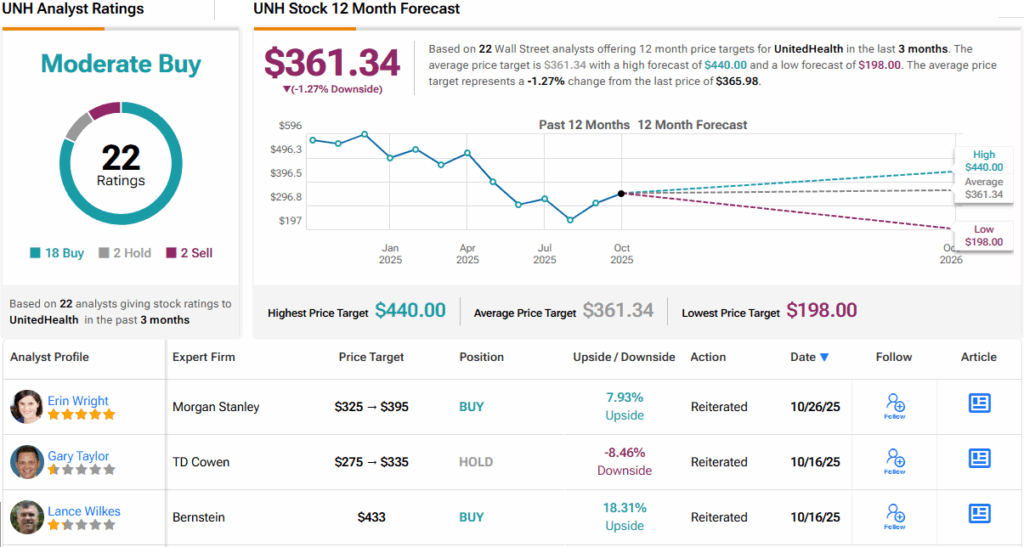

Elsewhere on the Street, UNH stock claims an additional 17 Buys and 2 Holds and Sells, each, all adding up to a Moderate Buy consensus rating. However, the $361.34 average price target suggests the stock is fully valued. (See UNH stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.