This week, numerous major players in the tech industry are set to unveil their earnings for the March quarter. However, the spotlight will truly shine next week when Apple (NASDAQ:AAPL) steps forward to announce its second fiscal quarter results, scheduled for Thursday, May 2nd.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Morgan Stanley analyst Erik Woodring, the results and reaction will follow a familiar path. “We see a similar earnings setup to 3 months ago, as we anticipate slight March quarter revenue upside but a fairly sizable June quarter guide-down vs. Consensus; a print we believe this market would punish,” the analyst explained.

Based on “iPhone and iPad build stability, slight Mac shipment upside, and Services outperformance,” Woodring anticipates a small March quarter beat, calling for revenue of $91.0 billion and EPS of $1.51 (up from the prior $89.9 billion and $1.48), both above the Street’s respective forecast of $90.0 billion and $1.50.

However, that take is turned on its head when considering the outlook for the June quarter. Here Woodring has an opposite stance, claiming consensus estimates “remain too aggressive.” The analyst expects Apple will guide for June quarter revenue and EPS 4-7% below Street forecasts and more along the lines of his calls for revenue of $80.0 billion and EPS of $1.22.

Essentially, Woodring thinks Street expectations for the iPhone are too high, with his $35.6 billion revenue forecast/39 million iPhone shipments landing 6% and 15%, respectively, below consensus.

“We’d highlight that there could be some upside to our iPhone shipment forecast as recent build strength implies up to 2M units of potential upside vs. our forecast, but given the general weakness of global iPhone demand, we keep our iPhone shipment forecast unchanged for now,” Woodring further said.

So, basically Woodring expects a decent quarterly readout but a downbeat reaction from investors on a weak outlook – a classic post-earnings scenario. But Woodring’s advice should that scenario actually play out is also a classic one: With Apple’s biggest WWDC ever taking place on June 10th, where Woodring anticipates new AI software features will be the focal point, he tells investors to “buy post-earnings weakness.”

All told, Woodring rates Apple shares an Overweight (i.e., Buy), although his price target is lowered from $220 to $210. Nevertheless, there’s still upside of 25% from current levels. (To watch Woodring’s track record, click here)

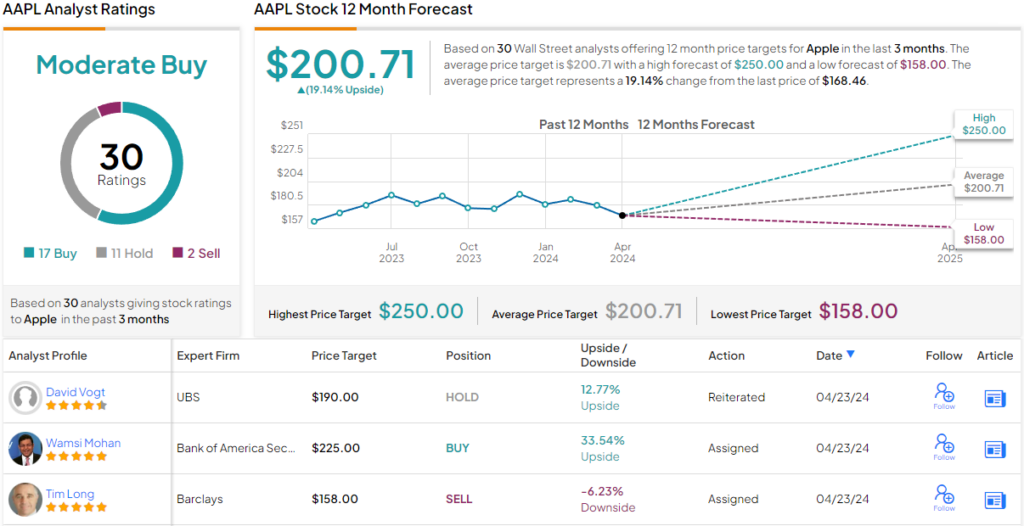

The Street’s average target is a little lower; at $200.71, the figure factors in one-year returns of 19%. On the rating front, based on 17 Buys, 11 Holds and 2 Sells, the analyst consensus rates the stock a Moderate Buy. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.