Wall Street investment bank Morgan Stanley (MS) has downgraded McDonald’s (MCD) stock, saying the restaurant chain’s pricing power has eroded.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

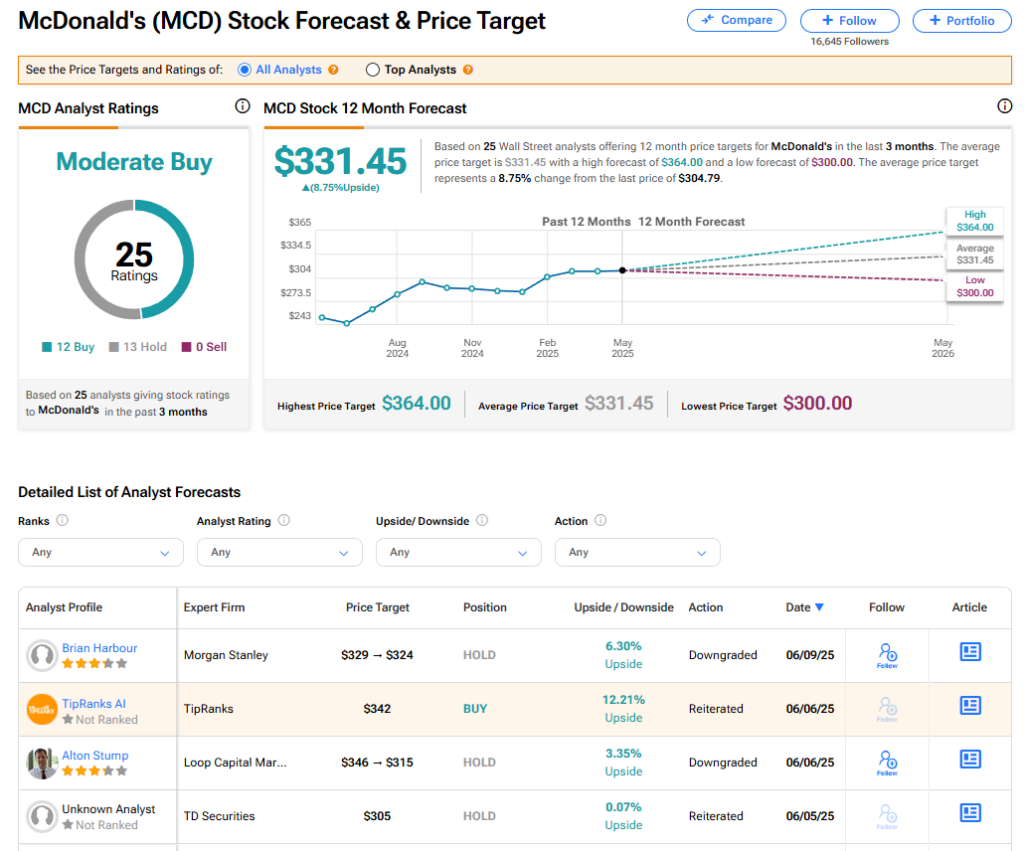

Analyst Brian Harbour dropped his rating on MCD stock to a Hold-equivalent equal-weight from a Buy-equivalent overweight previously. He also lowered his price target on McDonald’s shares to $324 from $329 previously. The revised price target implies about 7% upside from current levels.

In a note to clients, the Morgan Stanley analyst said that McDonald’s is currently trading at a premium as investors on both Wall Street and Main Street believe that it’s a defensive stock should the U.S. economy slow substantially. However, Harbour wrote that “pricing power has eroded” at McDonald’s restaurants.

Coming Headwinds

Harbour added that there are likely more headwinds coming for low-income consumers who eat frequently at McDonald’s. What’s more, he said, “structural shifts in consumer tastes” such as the increased popularity of weight-loss drugs are likely to be a long-term negative for MCD stock.

Morgan Stanley is the second Wall Street firm to recently downgrade McDonald’s stock. Loop Capital lowered its rating on MCD stock to Hold from Buy and cut its price target to $315 from $346 previously, citing concerns about negative consumer views of the company’s McCrispy chicken strips.

MCD stock has risen 6% this year.

Is MCD Stock a Buy?

The stock of McDonald’s has a consensus Moderate Buy rating among 25 Wall Street analysts. That rating is based on 12 Buy and 13 Hold recommendations issued in the last three months. The average MCD price target of $331.45 implies 8.75% upside from current levels.