For the first time—ever, by some reports—Morgan Stanley analysts downgraded Charles Schwab (NYSE:SCHW) from “overweight” to “equal weight.” The ratings cut sent Schwab slumping, down over 5.5% at the time of writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The hit came from Morgan Stanley analyst Michael Cyprys, who suggested that it was time to pull back until there was a little less uncertainty surrounding the bank stock. There was quite a bit of uncertainty involved, too; reports noted that customers were shifting from sweep accounts to money market accounts at the right of about $20 billion per month. That’s over double what Cyprys’ models were looking for, which suggests a lot of uncertainty indeed.

While that’s certainly a problem, it’s not that big of a problem. Schwab brass recently detailed its overall battle plan, which actually includes a scenario in which customers pull their balances en masse. Throw in recent nods from JPMorgan analyst Ken Worthington that suggest the odds of a “bank-type run” at Schwab were about as low as the sun rising in the west some morning, and that adds up to good news overall. Still, uncertainty is uncertainty, and Cyprys is taking that into account.

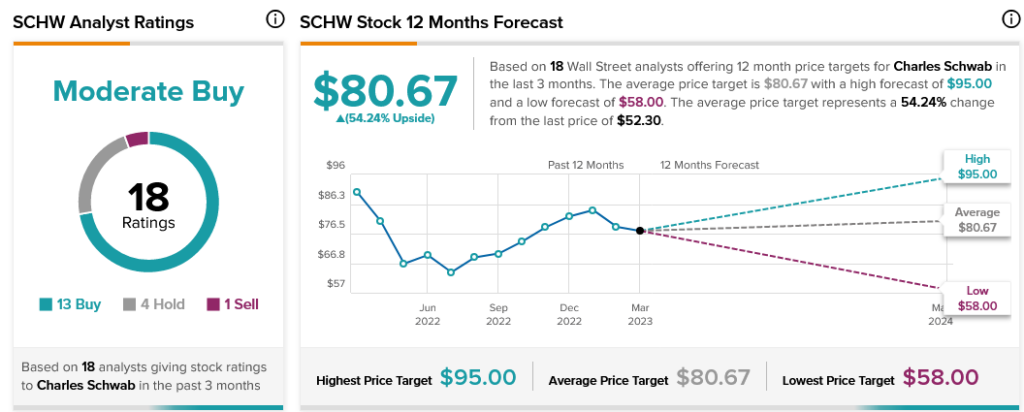

Cyprys may be pulling back, but he’s in the minority. Analyst consensus calls Charles Schwab a Moderate Buy with 13 Buy recommendations against just four Holds and one Sell. Plus, Schwab stock offers 54.24% upside potential thanks to its average price target of $80.67 per share.