Plug Power (NASDAQ:PLUG) is slumping today, and pretty badly. Investors drove it down over 6% in Monday afternoon’s trading largely because of a big new analyst downgrade that cost it a lot of confidence.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The downgrade came from Andrew Percoco, a Morgan Stanley analyst. Where previously, Percoco had a Buy on the stock, now it was just a Hold. That prompted a lot of investors to reconsider their positions, and shares went down accordingly. Percoco wasn’t completely down on Plug Power, as he liked its plans to step up vertical integration in its operations. However, Plug Power isn’t profitable yet, and getting there may take a while.

Percoco instead prefers Bloom Energy (NYSE:BE), which he considers a “key beneficiary” of increasingly limited power grid capabilities and clean hydrogen tax credits. Meanwhile, others have pointed out that Plug Power’s value is up, but that improved value hasn’t translated much to shareholders. In addition, Plug Power’s sustainability has also been called into question on at least one occasion. That’s a serious potential problem, especially with its comparatively narrow focus on fuel cells.

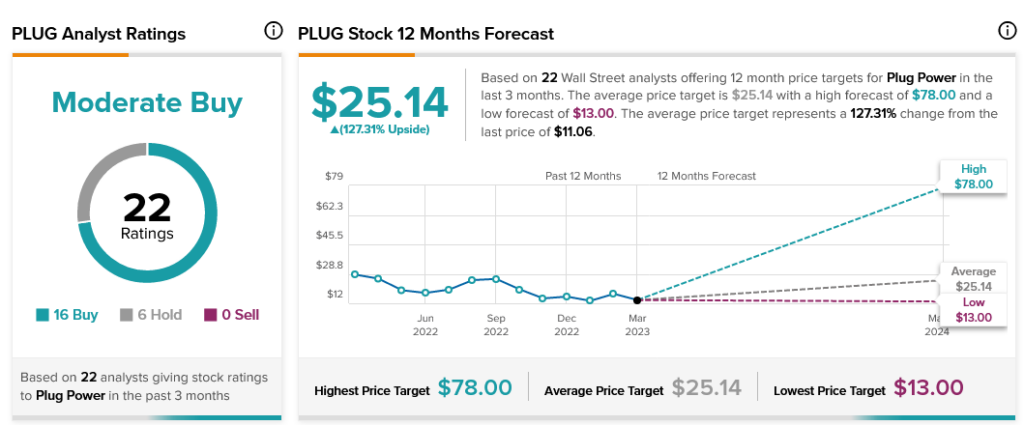

Despite the skepticism, however, there’s still plenty of analyst support here. Plug Power stock has a Moderate Buy consensus rating. Further, Plug Power shares come with 127.31% upside potential thanks to its average price target of $25.14.