Oh, Boeing (NYSE:BA), what will we do with you? Another report emerged of a plane having mechanical failures, though this one is somewhat different from the reports we’ve already heard. However, there are some signs that another part of Boeing—the Defense unit—may be able to help cover some of the shortfall from the passenger aircraft line. Good news enough for investors, as shares of the aircraft maker are up fractionally in Friday afternoon’s trading.

The latest report came as a Delta (NYSE:DAL) flight departing JFK International in New York City, heading for Los Angeles International, reported a “…flight deck indication related to the right wing emergency slide.” Furthermore, reports noted a “…sound from near the right wing.” However, this isn’t likely to hurt Boeing much, as the flight in question featured a 767-300 that entered Delta’s service back in 1990.

A newer plane having mechanical trouble is one thing. A plane that just celebrated its 34th birthday is another. It doesn’t help, of course—it’s one more problem in a growing stack of same—but it’s also not the kind of thing that will do much damage.

Help from the Defense Sector?

Another point emerged after a closer look at Boeing’s recently-released quarterly reports; there’s a sector of Boeing’s operations that’s much less often heard about but that could be delivering some new wins: defense. Reports note that sales may be on the decline, and Boeing’s plane quality issues are definitely a factor. However, the defense side of Boeing’s operations is showing signs of new life. Boeing’s defense sector operations brought in almost $7 billion in revenue by themselves for the first quarter, which is up 6% against this time last year. With overall production likely still sluggish through June, at least, it can use any help it can get from its other sectors.

Is Boeing Stock a Buy, Sell, or Hold?

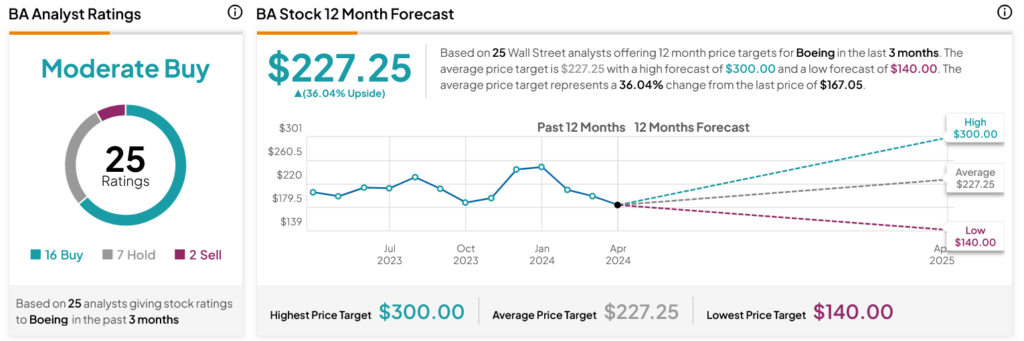

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 16 Buys, seven Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After an 18.04% loss in its share price over the past year, the average BA price target of $227.25 per share implies 36.04% upside potential.