Aerospace stock Boeing (BA) had a fantastic week this week, and it may be about to come to an end with the end of another major issue. Reports suggest that Boeing may be in line for a plea deal with the government as the criminal case is about to be dropped in the two crashes from last year. The victims’ families are calling it “morally repugnant,” but investors seem to agree, sending Boeing shares down fractionally in Friday afternoon’s trading.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Boeing accepted a plea deal last year that would have required it to plead guilty in the events surrounding the crash. At the time, this was decried as a “sweetheart deal” and a “get out of jail free card for Boeing.” The deal was ultimately rejected by Judge Reed O’Connor, a move he now likely regrets. Now, the Justice Department is now planning to drop the criminal case altogether, reports note.

This move, the Boeing families are calling “morally repugnant,” as the Justice Department is now seeking a “non-criminal settlement” featuring an additional $444.5 million that would be divided up equally per crash victim. An attorney for 16 of the victims, Sanjiv Singh, said that the move “…feels like a bribe.” Neither Boeing nor the Justice Department would comment.

Another Big Sale

Jacking up the victim fund will likely be mixed news to Boeing anyway, especially after its major new sale that represented the largest such sale in its history. If that were not enough, Boeing also landed another major sale in the Middle East. It may not have been as good as the Qatari sale, but Etihad Airways picked up 28 new Boeing jets on its own.

Not only did Etihad Airways pick up 28 new jets—both 777X and 787 models—but it also announced that it would start up flights to Charlotte, North Carolina. While it was unclear just how many of each were ordered, reports suggested more specific information would follow soon. For now, though, it is a hefty new order, and one that represents a big swing in Boeing production. How do we know? The planes are slated for delivery in 2028. Given that Boeing has a backlog going back over 10 years as it is, for Etihad to look for these planes in three years suggests Boeing really plans to fire up the lines.

Is Boeing a Good Stock to Buy Right Now?

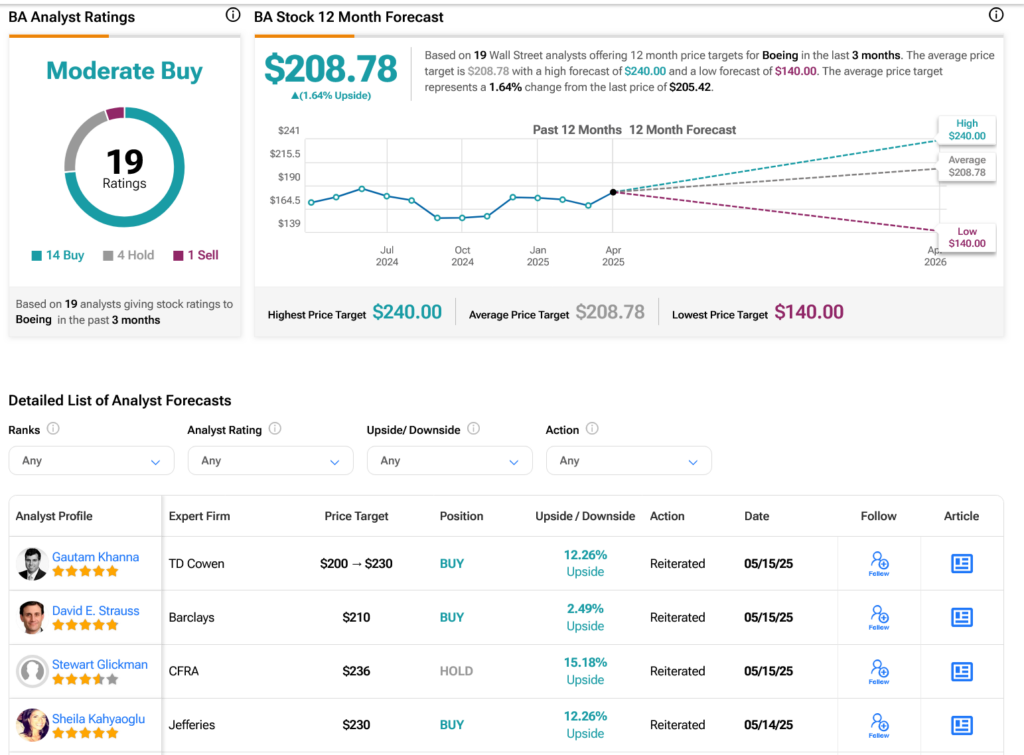

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 14 Buys, four Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 11.51% rally in its share price over the past year, the average BA price target of $207.78 per share implies 1.64% upside potential.