Software maker Monday.com (MNDY) delivered a better-than-expected third quarter but still lost investor confidence almost instantly. Despite topping estimates on both earnings and revenue, the company’s softer outlook for the coming quarter sent shares tumbling nearly 19% in premarket trading to $153.76.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The report indicated another instance where solid execution wasn’t enough to overcome cautious forward guidance in a market that has little patience for slowing growth.

Earnings Beat Delivers, but Optimism Fades Fast

Monday.com’s third-quarter results easily cleared Wall Street’s expectations. Adjusted earnings were $1.16 per share, above the $0.88 forecast, while revenue rose 26% to $316.9 million. The company showed solid margin improvement and steady customer growth, signaling healthy demand.

Still, optimism was short-lived. The last two earnings reports have followed a similar pattern—beats on revenue and profit followed by weaker guidance that rattles investors. For traders hoping the AI rollout would drive a more confident tone, this update felt like déjà vu.

Weak Outlook Sparks Renewed Selling Pressure

The company’s guidance triggered the selloff. Monday.com forecast fourth-quarter revenue of $329 million, a few million short of the $333.7 million analysts expected. Even that small gap was enough to shake confidence. Shares plunged as investors questioned whether the company’s growth engine is slowing.

Software valuations leave little room for hesitation. With many peers also signaling caution, investors are quick to punish even minor disappointments. Monday.com’s leadership emphasized long-term profitability and efficiency, but near-term momentum remains the market’s main focus.

AI Ambitions Expand, but Proof of Impact Still Pending

Monday.com continues to invest heavily in AI. The company launched three new AI-driven features in July aimed at automating workflows and improving productivity. These updates align with its goal of becoming a more intelligent “work operating system” for enterprise teams.

However, investors are waiting for measurable results. AI remains more of a narrative than a revenue driver so far, and Wall Street wants proof that adoption can lift customer spending and retention. Until then, the market is treating AI optimism with skepticism.

Competition Intensifies across the Software Landscape

Monday.com faces stiff competition from Atlassian (TEAM) and Asana (ASAN), both pushing similar collaboration and project management tools. Atlassian shares ticked higher last week, while Asana slipped, highlighting how uneven sentiment has become across the sector.

With the broader Nasdaq Composite trending higher, Monday.com’s sharp decline appears specific to its own outlook rather than a macro issue. Regaining credibility will require clearer evidence that AI and enterprise demand can power the next leg of growth.

What Lies Ahead for Monday.com

Investors now want reassurance that the cautious tone reflects prudence, not softening demand. Clearer communication on pipeline health, renewal rates, and customer expansion could help rebuild confidence. Margin discipline and consistent profitability will also remain under the microscope.

Monday.com still has strong fundamentals and a growing enterprise base. But in a crowded market, investors need to see acceleration, not just ambition. The next few quarters will show whether the company can turn solid execution into renewed investor trust.

Is Monday.com a Good Stock to Buy?

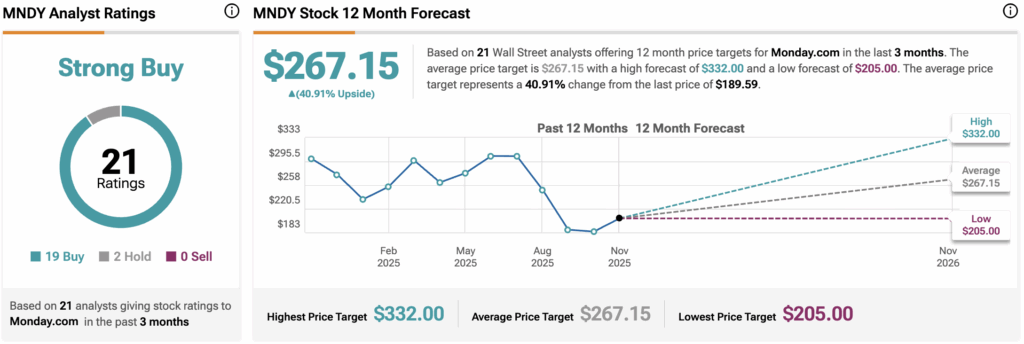

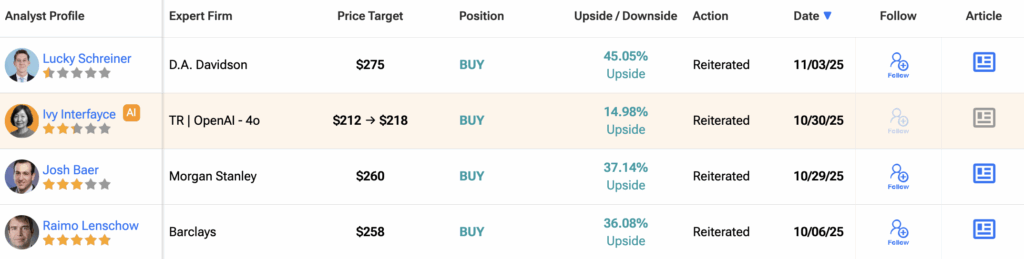

TipRanks’ analyst data shows a surprisingly bullish outlook despite the stock’s sharp post-earnings drop. Out of 21 Wall Street analysts, 19 rate the stock a Buy, two say to Hold, and none say a Sell, giving it a consensus “Strong Buy” rating.

The average 12-month MNDY price target sits at $267.15, implying nearly 41% upside from the latest price.