Cloud-based work management platform Monday.com (NASDAQ:MNDY) fell in pre-market trading even as the company delivered an earnings beat in the fourth quarter. The company reported adjusted earnings of $0.65 per diluted share compared to earnings of $0.44 per share in the same period last year. This was nearly double analysts’ expectations of $0.33 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Monday.com posted revenues of $202.6 million, a surge of 35% year-over-year and above consensus estimates of $197.9 million. The company’s number of customers with more than $50,000 in annual recurring revenue (ARR) grew 56% year-over-year to 2,295 as of December 31, 2023. In addition, Monday.com’s paid customers with more than $100,000 in ARR was 833, up 58% year-over-year.

Looking forward to the first quarter, the cloud-based platform expects revenues in the range of $207 million to $211 million, while adjusted operating income is likely to be between $8 million and $12 million. In FY24, the company is projecting revenue in the range of $926 million to $932 million, while adjusted operating income is expected to be between $58 million and $64 million.

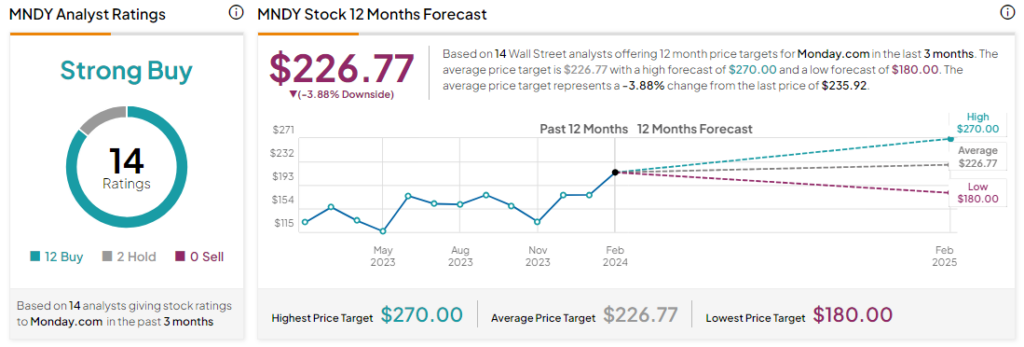

What Is the Price Target for Monday.com?

Analysts remain bullish about MNDY stock with a Strong Buy consensus rating based on 12 Buys and two Holds. Over the past year, MNDY has soared by more than 60%, and the average MNDY price target of $226.77 implies a downside potential of 3.8% at current levels.