Molina Healthcare (MOH) stock plunged 20% on Thursday, as of writing, as the health insurer slashed its full-year earnings guidance, citing elevated medical costs, mainly in its Marketplace business. While MOH’s Q3 revenue exceeded the Street’s expectations, its adjusted earnings per share (EPS) drastically missed the consensus estimate.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

MOH’s weak outlook dragged down stocks of other health insurers. Shares of UnitedHealth (UNH), Centene (CNC), Humana (HUM), and Elevance Health (ELV) were down 1.2%, 6.7%, 1.9%, and 1.2%, respectively, in Wednesday’s after-hours trading.

Higher Medical Costs Weigh on Molina’s Q3 Earnings

Molina Healthcare reported an 11% year-over-year growth in its Q3 revenue to $11.48 billion, surpassing the consensus estimate of $10.97 billion. The company’s premium revenue grew 12% to $10.8 billion, driven by recent acquisitions, rate increases, and growth in the current footprint.

However, MOH’s Q3 adjusted EPS plunged 69.4% to $1.84 and significantly lagged the Street’s consensus forecast of $3.90. The contribution of Molina’s Medicaid business to the company’s bottom line was more than offset by the losses related to the performance of its Medicare and Marketplace businesses. CEO Joseph Zubretsky stated that more than half of MOH’s underperformance was due to the Marketplace business, which serves individuals under the Affordable Care Act (ACA).

Notably, elevated medical costs due to continued high levels of utilization adversely impacted the Medical Care Ratio (MCR) across the Medicaid, Medicare, and Marketplace businesses. MOH’s consolidated Q3 MCR increased to 92.6% compared to 89.2% in the prior-year quarter. In particular, the Marketplace segment was the worst hit, with its MCR jumping to 95.6% from 73.0% in Q3 2024.

“The headline for the quarter is that approximately half of our underperformance is driven by the Marketplace business, and that Medicaid, while experiencing some pressure, is producing strong margins,” said CEO Zubretsky.

MOH Slashes Full-Year Earnings Guidance

While Molina increased its full-year revenue outlook, it significantly lowered its earnings guidance due to the “unprecedented medical cost trend” in its Marketplace business.

The company now expects 2025 premium revenue and total revenue of $42.5 billion and $44.5 billion, respectively, compared to the prior outlook of $42 billion and $44 billion, respectively.

Molina now expects 2025 adjusted EPS of about $14 per share, down from its prior outlook of at least $19. It is worth noting that Molina had already reduced its annual earnings guidance twice earlier this year, citing cost headwinds in its ACA plans.

Is Molina Stock a Buy?

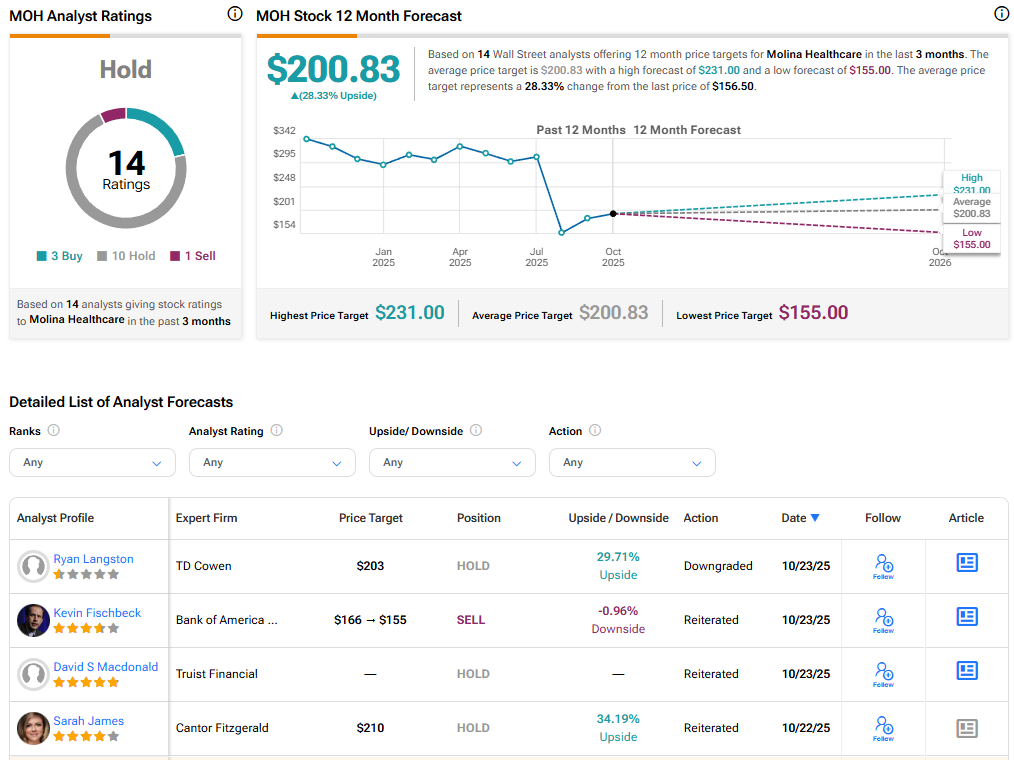

Currently, Wall Street has a Hold consensus rating on Molina Healthcare stock based on 10 Holds, three Buys, and one Sell recommendation. The average MOH stock price target of $200.83 indicates 28.3% upside potential.

These price targets/ratings are expected to be revised as more analysts react to the poor earnings outlook.