Coliseum Capital Management, LLC, a director at ModivCare (NASDAQ:MODV), purchased 90,743 shares of the company in multiple transactions on December 1 and December 2, for a total value of $6.9 million. MODV stock surged about 6% on Monday and a further 1.2% in the extended trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

ModivCare is a technology-enabled healthcare services company that provides supportive care solutions for public and private payors and their patients.

Christopher Shackelton, the chairman of the board of ModivCare, is also the manager of Coliseum Capital and has an ownership interest in it.

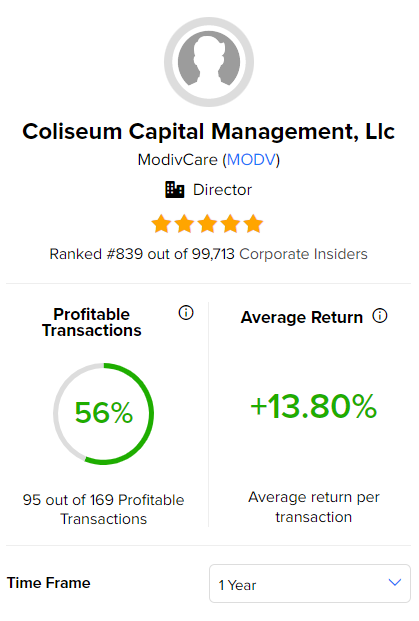

The total value of Coliseum Capital’s holdings of MODV stock currently stands at $106.4 million. Overall, Coliseum Capital’s performance track record shows a 56% success rate in 169 transactions in the past year, with an impressive average return of 13.8% per transaction.

TipRanks’ Insider Trading Activity Tool shows that insider confidence in ModivCare stock is currently Positive.

Interestingly, TipRanks offers daily insider transactions and a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is MODV a Good Stock to Buy?

On TipRanks, MODV stock has a Moderate Buy consensus rating based on two Buys. The average stock price target of $119 implies 45.1% upside potential. The stock is down more than 43% so far this year.

Moreover, MODV seems to be significantly undervalued. Currently, the stock’s price/sales ratio is trading at 0.48x, which reflects an 88.9% discount to the sector’s median of 4.32. Also, ModivCare has a beta of 0.75. A beta value of less than 1 indicates that the stock is less volatile than the market.