Moderna (NASDAQ:MRNA), a biotechnology and pharma company, gained in pre-market trading after announcing positive clinical data in the trial of a treatment for melanoma. The company announced follow-up data from the Phase 2b randomized clinical trial that evaluated mRNA-4157 (V940), an investigational individualized neoantigen therapy (INT), in combination with Keytruda. Keytruda is Merck’s (MRK) anti-PD-1 therapy, which is used in patients with resected high-risk melanoma.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This data, with a median follow-up period of three years, indicated that treatment with mRNA-4157 (V940) in combination with Keytruda showed a clinically meaningful improvement in recurrence-free survival (RFS), reducing the risk of recurrence or death by 49% compared with Keytruda alone. mRNA-4157 (V940) in combination with Keytruda also demonstrated a “meaningful improvement in distant metastasis-free survival (DMFS), compared with KEYTRUDA alone, reducing the risk of developing distant metastasis or death by 62%.”

Based on this data, the U.S. Food and Drug Administration and European Medicines Agency have granted Breakthrough Therapy Designation and the Priority Medicines (PRIME) scheme, respectively, for mRNA-4157 (V940) in combination with KEYTRUDA for the treatment of patients with high-risk melanoma.

What is the Future Price of MRNA Stock?

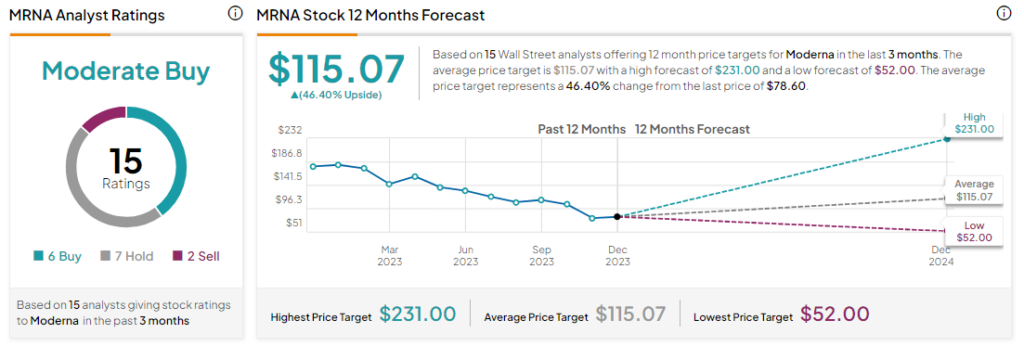

Analysts remain cautiously optimistic about MRNA with a Moderate Buy consensus rating based on six Buys, seven Holds, and two Sells. MRNA stock has dropped by more than 60% in the past year and the average MRNA price target of $115.07 implies an upside potential of 46.4% at current levels.