Global biotechnology company Moderna (NASDAQ:MRNA) has signed a deal to research, develop, and manufacture its messenger RNA (mRNA) medicines in China. The company has signed a memorandum of understanding (MOU) and a related land collaboration agreement to manufacture drugs “exclusively for the Chinese people” and vowed that those will not “be exported”. Following the news, MRNA stock rose 1.5% to close at $123.54 on July 5.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Moderna issued a statement confirming the deal but has not revealed any monetary specifics. Meanwhile, some Chinese media outlets suggest that Moderna’s first-ever investment in China could be worth roughly $1 billion. The news also stated that Moderna CEO Stephane Bancel is visiting the capital to finalize the deal.

Moderna Enters China Despite All Odds

China, which is considered the world’s second-largest market with its humongous population, has always been hostile towards American investments in the nation. Moderna’s decision comes as a surprise given the growing animosity between the two nations and the ongoing trade war. However, China has recently stated that it is open to foreign pharmaceutical investments.

Moderna is seeking to take full advantage of the situation to develop its mRNA drugs in the country. mRNA medicines are known to aid human cells in producing an immune response against a virus. The same technique helped boost the adoption of its mRNA-based COVID-19 vaccine. Moderna has agreements with several nations for the export of its vaccines, this is the first one with China. If all goes well, the deal could open up a big market for Moderna’s medicines, helping it generate millions of dollars in sales.

What is the Prediction for Moderna Stock?

Wall Street is cautiously optimistic about MRNA stock. On TipRanks, MRNA has a Moderate Buy consensus rating based on six Buys, four Holds, and one Sell rating. Also, the average Moderna stock prediction of $224.30 implies an impressive 81.6% upside potential from current levels. Meanwhile, MRNA stock has lost nearly 31% so far this year.

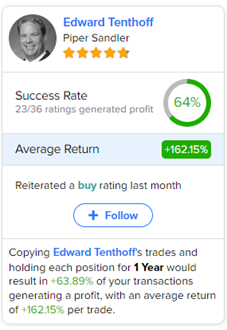

Further, investors looking for the most profitable analyst for MRNA could follow analyst Edward Tenthoff of Piper Sandler. Copying his trades on this stock and holding each position for one year could result in 64% of your transactions generating a profit, with an average return of a whopping 162.15% per trade.