Moderna (NASDAQ:MRNA) stock received two Buy ratings from bullish analysts after the company said that it expects the launch of several vaccines in the next two years to drive sales growth in 2025. It is worth highlighting that MRNA stock gained over 13% on Tuesday and another 2.1% in the after-hours trading session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The biotechnology company develops vaccines based on messenger ribonucleic acid (mRNA) for the treatment of infectious diseases, immuno-oncology, rare diseases, and cardiovascular diseases.

Here’s What Analysts are Saying

Among the optimistic analysts, Hartaj Singh from Oppenheimer upgraded the stock’s rating to Buy from Hold. The analyst expects MRNA to have five products on the market by 2026, which might drive its topline growth. Also, Singh is impressed with the company’s cost control strategies.

Furthermore, he expects COVID-19 vaccine sales to improve in 2025. The expectation is backed by rising cases in the U.S. following the emergence of a new variant, JN.1. Singh has a price target of $142 per share on MRNA, which implies a 26.2% upside potential.

Likewise, Brookline Capital Markets analyst Leah Rush Cann remains highly optimistic about the company’s prospects. Cann raised the price target on Moderna to $310 (175.6% upside) from $300 while maintaining a Buy rating.

What is the Forecast for MRNA Stock?

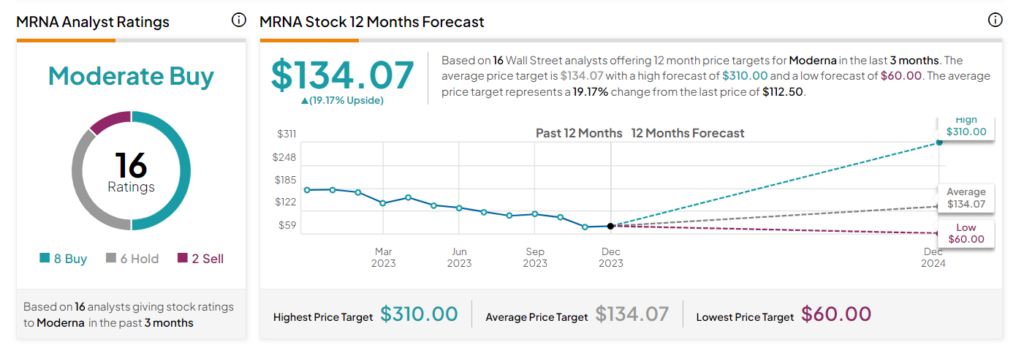

Wall Street analysts are cautiously optimistic about Moderna stock. It has a Moderate Buy consensus rating based on eight Buys, six Holds, and two Sells. The average MRNA stock price target of $134.07 implies a 19.2% upside potential. Shares of the company have declined 7.6% over the past six months.