Moderna (NASDAQ:MRNA) and Merck (NYSE:MRK) recently disclosed promising results from the mid-stage trial of combination therapy for the treatment of Melanoma, a type of skin cancer. The results showed that the therapy reduced the risk of death or recurrence of Melanoma by 44% in comparison to Merck’s cancer drug Keytruda alone.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The combination therapy consists of Moderna’s personalized mRNA-4157 (V940) cancer vaccine and Merck’s Keytruda. It is important to note that after 18 months, 79% of melanoma patients in the trial were cancer-free, as opposed to 62% of those who received only Keytruda treatment.

The firms intend to start the Phase 3 study later this year after discussing the findings with regulatory authorities. Additionally, they intend to extend the treatment to additional tumor types, like non-small cell lung cancer.

Remarkably, both the U.S. Food and Drug Administration and the European Medicines Agency have recognized the treatment as a breakthrough therapy.

Positive trial outcomes are known to boost healthcare companies’ stock prices. Therefore, it would be reasonable to anticipate that the most recent advancement in the cancer drug trial may raise the price of MRNA and MRK stocks on Monday.

It is worth noting that Merck recently announced the acquisition of Prometheus Biosciences (RXDX) for $10.8 billion. The deal should strengthen Merck’s presence in the field of immunology.

What is the Prediction for MRNA?

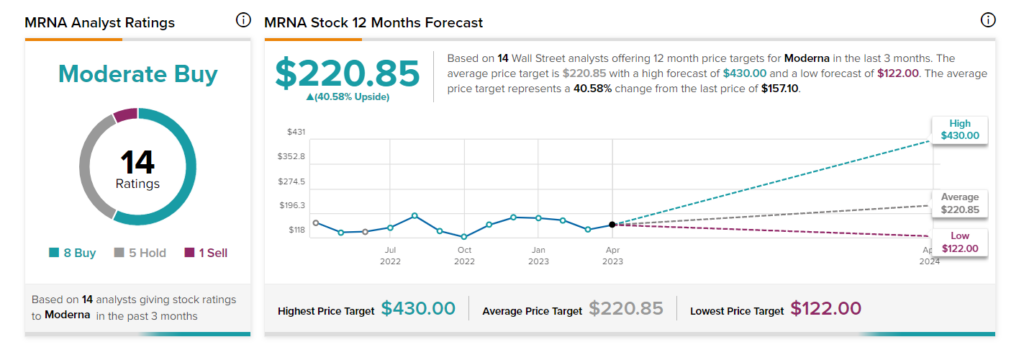

Wall Street remains cautiously optimistic about MRNA stock. This is based on eight Buys, five Holds, and one Sell. At $220.85, the average price target implies a 40.6% upside. MRNA stock is down 12.3% so far this year.

Is Merck a Buy, Sell, or Hold?

Merck has a Strong Buy consensus rating based on 15 Buy and five Hold ratings assigned over the last three months. The average Merck stock price target of $120.50 implies upside potential of 4.5%. The stock is up 4.5% so far in 2023.