The U.S. FDA (Food and Drug Administration) identified quality control lapses at Moderna’s (NASDAQ:MRNA) manufacturing facility. According to a Reuters report, the lapses included issues associated with the equipment used by MRNA, a biopharmaceutical company, to produce the drug substance for its COVID-19 vaccine.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s dig deeper.

The FDA Inspection

Per the report, the inspection was conducted in September at Moderna’s Norwood, Massachusetts, facility. This site is responsible for manufacturing the COVID-19 vaccine, Spikevax. The FDA did not specify whether the batches containing the concerned drug substances were released to the public.

Moderna, however, affirmed that the results do not give rise to worries regarding the excellence or safety of their offerings. The company emphasized the safety and efficacy of its COVID-19 vaccines, stating that all released products underwent rigorous testing, meeting both product specifications and international regulatory standards.

Despite Moderna’s assurances, the FDA report pointed out deficiencies in the company’s facility. These included insufficient measures to prevent the use of expired materials in vaccine production and to ensure that airborne contaminants do not compromise product integrity.

With this background, let’s look at the Street’s forecast for MRNA stock.

What is the Price Target for Moderna Stock?

Moderna stock has dropped approximately 52% year-to-date, reflecting a massive drop in its top line due to the substantial decrease in sales of its COVID-19 vaccine. Due to the dip in volumes of COVID-19 vaccines, analysts maintain a cautiously optimistic outlook on MRNA stock. Further, quality control issues could damage the company’s image and further hurt its vaccine sales.

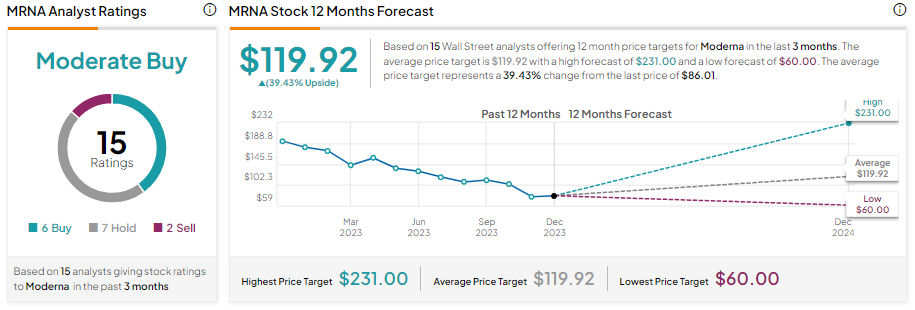

Moderna stock has a Moderate Buy consensus rating with six Buy, seven Hold, and two Sell recommendations. Further, as its stock lost notable value, analysts’ average price target of $119.92 implies 39.43% upside potential from current levels.