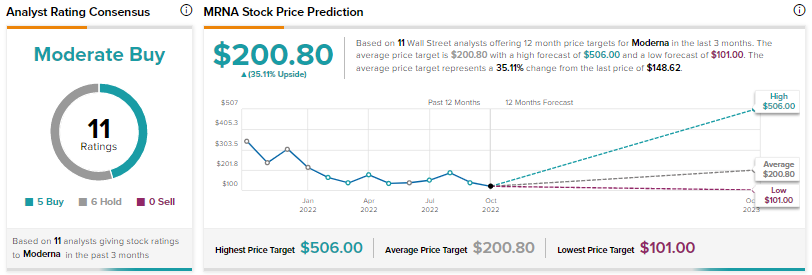

Shares of Moderna (NASDAQ: MRNA) plunged in pre-market trading on Thursday as the messenger RNA (mRNA) biotechnology company’s Q3 earnings missed estimates. The company posted revenues of $3.4 billion, a drop of 32% year-over-year, missing Street estimates by $170 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The fall in revenues was mainly due to a decline in sales of its COVID-19 vaccines.

Diluted earnings came in at $2.53 per share, a drop of 67%, again falling short of analysts’ estimates of $3.3.

Stéphane Bancel, Moderna’s CEO stated, “Today’s earnings continue to show strong corporate momentum. With $13.6 billion in product sales through the first three quarters of the year, and advance purchase agreements for anticipated delivery this year now expected to produce around $18 to $19 billion of product sales, we continue to have a strong financial position as we prepare for multiple upcoming global product launches.”