Shares in Mobileye (NASDAQ:MBLY) are on the rise as Wells Fargo recently began coverage on the company, giving it a favorable ‘overweight’ rating. Analyst Aaron Rakers set a per-share price target of $50, recognizing Mobileye’s early progress in revolutionizing the automotive industry towards full autonomy in the next decade.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A notable element in the company’s strategy, according to Rakers, is the expansion of its SuperVision platform. He predicts that it could generate revenue between $3.2 billion and $7 billion over the next five years, and a significant partnership with a leading manufacturer would be a significant development.

Despite this positive outlook, Mobileye, which spun off from Intel in 2022 but remains majority-owned by the chip powerhouse, recently cut its full-year guidance. This decision was due to market challenges, including economic weakness and pricing shifts in the Chinese electric vehicle market, led by Tesla.

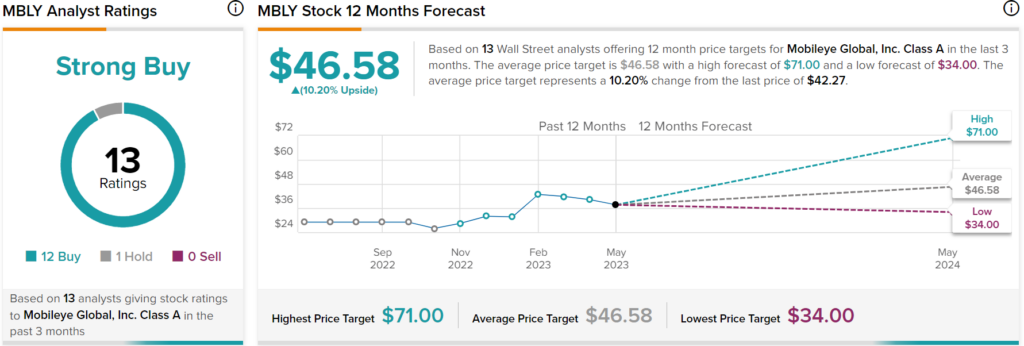

Overall, Wall Street analysts have a consensus price target of $46.58 on MBLY stock, implying 10.2% upside potential, as indicated by the graphic above.