When Citi starts suggesting catalysts are involved in a stock’s near future, that stock tends to do pretty well, if only in the short term. Mobileye Global (NASDAQ:MBLY) saw as much in Wednesday afternoon’s trading when it jumped over 6.5% on news of Citi spotting catalysts in its own operations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Citi looks for a “potentially catalyst-rich” period for Mobileye to follow between now and roughly March of next year. Under the right conditions, the catalyst-rich period could go as far as next September. That’s the word from Itay Michaeli, a Citi analyst who notes that there’s been a lot of new interest in autonomous driving systems as of late and that interest is showing up in the form of purchased systems. Plus, Michael notes, Mobileye’s Chauffeur Level 4 systems, along with the SuperVision systems, are each adding to Mobileye’s overall success.

Indeed, Mobileye landed a big new deal only recently, poised to supply its SuperVision and Chauffeur platforms to FAW Group, a major Chinese automaker. Not only will Mobileye offer those systems outright, but the two firms will also establish a “technical alliance” in which they’ll work together on some developments. The financial terms of the deal weren’t disclosed as of yet, but the deal is likely substantial. Mobileye will be supplying tech to a range of vehicles produced by FAW Group, starting with the Hongqi line of premium vehicles.

What is the Target Price for Mobileye Stock?

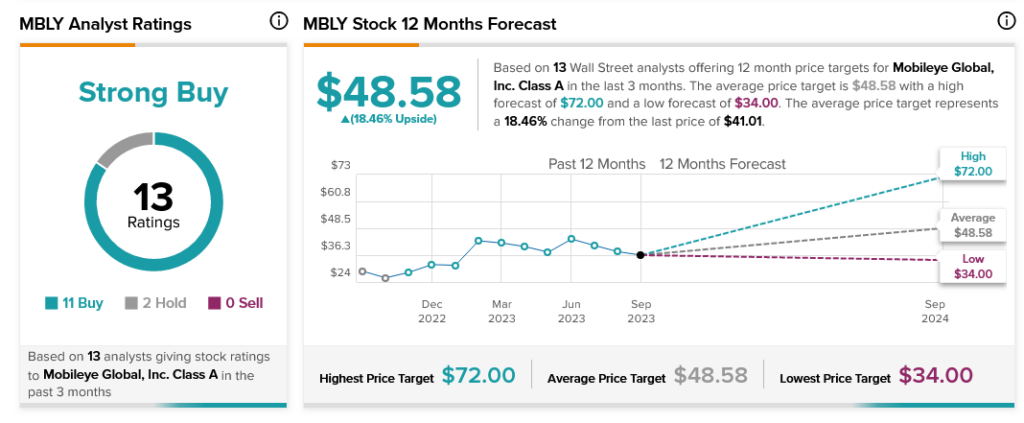

Mobileye also enjoys strong support from analysts. In fact, Mobileye stock is currently rated a Strong Buy by analyst consensus, thanks to a combination of 11 Buy ratings and two Holds. Further, with an average price target of $48.58, Mobileye stock boasts an upside potential of 18.46%.