Shares of autonomous driving solutions provider Mobileye Global (NASDAQ:MBLY) are moving upward today after it announced better-than-anticipated second-quarter numbers. While revenue declined 1% year-over-year to $454 million, the figure still landed ahead of estimates by about $2.9 million. EPS at $0.17 too surpassed expectations by $0.05.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In Q2, the business development pipeline remained strong with a sequential improvement in operating margins despite a flat top line. MBLY continues to expand its ADAS (advanced driver assistance systems) expertise and became the first company to offer a vision-only solution to OEMs after its recent certification win in Europe.

Looking ahead, for the full-year 2023, MBLY now expects revenue to hover between $2,065 million and $2,114 million. Adjusted operating income is anticipated between $600 million and $631 million. Impressively, the company had a cash pile of $1.1 billion and was debt free as of July 1, 2023.

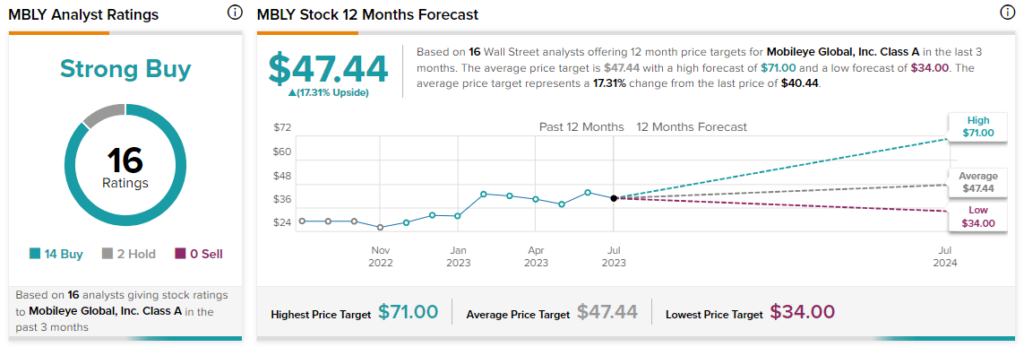

Overall, the Street has a $47.44 consensus price target on MBLY alongside a Strong Buy consensus rating. Shares of the company have exploded nearly 23.6% so far this year.

Read full Disclosure