Much like Charlie Brown’s Christmas tree, sometimes all a stock needs to jump in the market is a little love. That’s what happened to Mobileye (NASDAQ:MBLY) today, which is up substantially in today’s trading after JPMorgan started analyst coverage on the company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

JPMorgan analyst Samik Chatterjee started the ball rolling for Mobileye, giving the company a Buy rating and a price target of $50 per share. A good rating by itself, but Chatterjee’s reasoning is likely to fuel some investment in Mobileye. Chatterjee noted that the company is “driving ahead,” citing both solid fundamentals and its current leadership. Throw in a solid cash flow and margins that few in the industry can match, and that’s a solid picture for Mobileye.

Chatterjee saved the biggest feather in Mobileye’s cap for last. He also noted that Mobileye is likely to end up “…the largest stand-alone autonomous driving company.” The market itself will likely see a compound annual growth rate of 38%. That suggests a strong positive outcome for Mobileye and its investors.

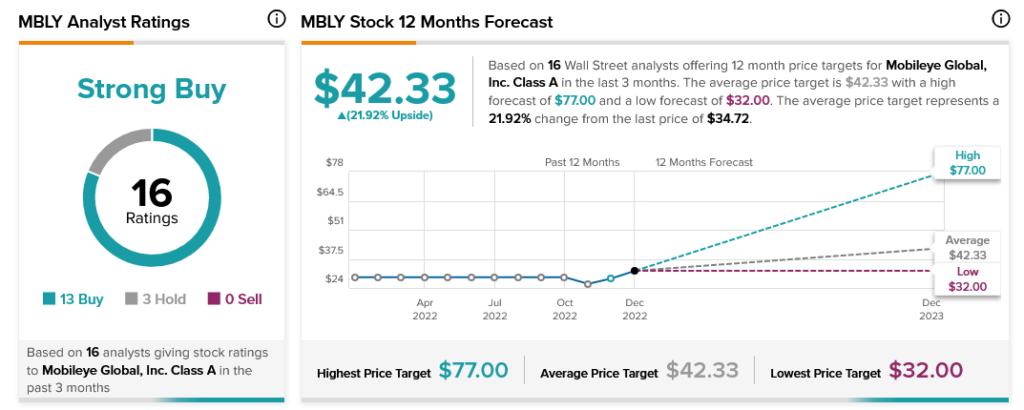

The broader analyst consensus, meanwhile, clearly agrees with Chatterjee. Mobileye is considered a Strong Buy, with over four times the number of Buy recommendations as Holds. The company even has a solid 21.92% upside potential, thanks to its average price target of $42.33 per share.