The notion of a self-driving car has been front-of-mind for everyone from investors to corporate magnates for years. Are we any closer? That’s debatable, but stocks like Mobileye Global (NASDAQ:MBLY) are going to pursue it anyway. And while Mobileye may not specifically be an AI stock, Morgan Stanley suggests you consider it anyway. That suggestion didn’t help matters much for Mobileye, as shares slipped fractionally at the time of writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Morgan Stanley, by way of analyst Adam Jonas, restarted coverage on Mobileye just recently. Mobileye landed a rating of “equal weight” and a price target of $34, with Jonas calling particular attention to the “less promotional nature of the company” and its “limited” free float. Those two factors could be giving Mobileye just a little less performance than it could be seeing right now. However, with an exposure to the automotive market, as well as its enviable position near the tip of the spear, Mobileye is certainly worth a closer look as far as Morgan Stanley is concerned.

Indeed, a recent development might give Mobileye a little extra push. Mobileye actually invented an artificial intelligence-driven tool that, when coupled with a standard camera, would basically prevent speeding from being possible. Dubbed Intelligent Speed Assist, it’s a step above current tools that depend on maps and GPS data for their speed limit monitoring, and instead use just the one camera and machine learning to know the correct speed and hold the car to no more than that limit. It can also simply warn the driver about speeding, for those times when speeding is necessary like medical emergencies.

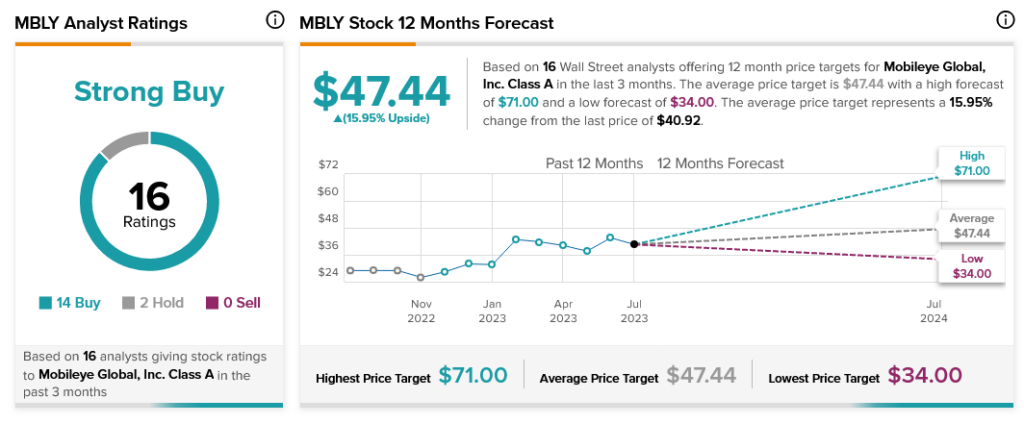

Overall, Mobileye rates as a Strong Buy with analysts, thanks to 14 Buy ratings and two Holds. With an average price target of $47.44, Mobileye stock offers investors a 15.95% upside potential.