Mizuho analyst Lloyd Walmsley initiated coverage of Meta Platforms (META) and Google parent Alphabet (GOOGL) with a Buy rating, reflecting his optimism about the growth potential of these tech stocks. In fact, Walmsley assigned social media giant Meta Platforms a “Top Pick” status with a price target of $925, saying that it is Mizuho’s “favorite long-term holding in Internet.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Mizuho Analyst Is Upbeat on META Stock

Walmsley believes that Meta Platforms has the “best leverage” to artificial intelligence (AI), machine learning (ML), and generative AI among Mizuho’s coverage. The analyst highlighted that META is transforming its user engagement, ad products, and operations by integrating AI across its product offerings and the 3.5 billion daily active users (DAU) base, without the structural risks that Google faces.

Furthermore, Walmsley believes that Meta’s ads business can maintain faster growth than any large player in the internet space, growing at 18% from 2024 to 2027, while making significant investments in augmented reality (AR), virtual reality (VR), and generative AI. The analyst expects the company to deliver Fiscal 2027 ad revenue of $265 billion, which is 3% above the Street’s consensus estimate.

He expects Meta Platforms to further bolster its position by monetizing newer tools like WhatsApp Status and Threads, and by eventually introducing ads in Meta AI, “tapping into the $226B annual global search ad market.”

GOOGL Stock Scores Mizuho’s Buy Rating

Walmsley assigned GOOGL stock a Buy rating with a price target of $295. He expects Alphabet to gain from the AI boom across major themes in advertising and cloud.

In particular, on the ad side, Walmsley stated that Alphabet is “exceptionally well-positioned” to benefit from new generative AI-native app advertising, AI/ML-led expansion in the total addressable market, and more time spent on YouTube due to AI-induced improvement in content quality.

The analyst believes that Alphabet’s AI Mode and Gemini offerings are curbing share losses, with recent SimilarWeb (SMWB) browser data indicating moderating share losses in terms of time/user/day against OpenAI’s (PC:OPAIQ) ChatGPT following the launch of AI Mode. “We believe the positive AI impact on ad tech to Google’s ad business has significant room to run,” said Walmsley.

Wall Street Is Bullish on META and GOOGL Stocks

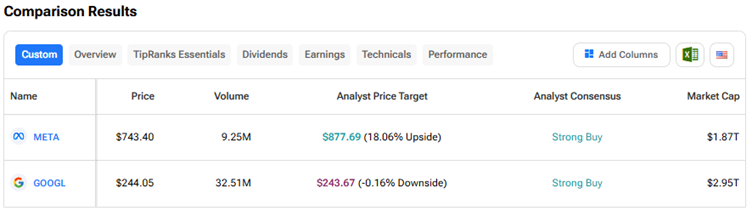

Using TipRanks’ Stock Comparison Tool, we see that Wall Street has a Strong Buy consensus rating on both META and GOOGL stocks. The average META stock price target of $877.69 indicates 18.1% upside potential. META stock has risen about 27% year-to-date.

Meanwhile, the average GOOGL stock price target of $243.67 implies that the stock is fully valued at current levels. GOOGL stock has jumped 29% year-to-date.