Shares of financial advisory and asset management firm Lazard Ltd. (LAZ) sank 6.6%, closing at $48.99 on October 29, after reporting lower-than-expected Q3 revenue.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lazard’s operating revenue rose 23% year-over-year to $701.64 million, yet failed to meet analyst estimates of $713.66 million. During the quarter, the firm’s revenue from the Financial Advisory segment grew 24% and the Asset Management segment climbed 19% compared to the same quarter last year.

Furthermore, Q3 adjusted earnings per share (EPS) stood at $0.98 per share, up by 46% year-over-year, and surpassed Street estimates of $0.95 per share. (See Insiders’ Hot Stocks on TipRanks)

The results were attributed to increased merger & acquisition (M&A) activities and global advisory services, coupled with management fees earned on higher assets under management (AUM). Lazard recorded quarter-end average AUM of $278 billion, growing 23% year-over-year.

Commenting on the firm’s quarterly performance, Kenneth M. Jacobs, Chairman and CEO of Lazard, said, “Record third-quarter and year-to-date operating revenue reflect continued strong performance across the firm globally… We are well-positioned with unprecedented advisory activity and a record level of average assets under management, and we continue to invest for growth across our businesses.”

Encouraged by the firm’s growing AUM, JMP Securities analyst Devin Ryan reiterated a Buy rating on the stock with a price target of $58, implying 18.4% upside potential to current levels.

Ryan expects Lazard to post record advisory revenue in Q4 and said, “We view 3Q21 earnings as solid, but we think the bigger takeaway from the quarter is the firm’s positioning into year-end and 2022, as management noted that it expects record fourth-quarter advisory revenues with ‘strong momentum’ into 2022.”

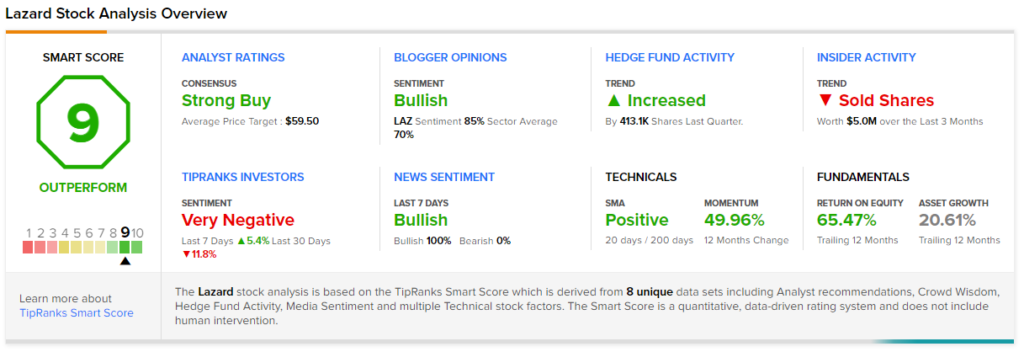

With 4 unanimous Buys, the stock commands a Strong Buy consensus rating. The average Lazard price target of $59.50 implies 21.45% upside potential to current levels. Shares have gained 39.2% over the past year.

What’s more, Lazard scores a 9 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Caterpillar Jumps 4% on Q3 Outperformance

Western Digital Plunges 10% After-Hours Despite Solid Q1 Beat

Yum! Brands Delivers Outstanding Q3 Results