An utter bombshell hit the COVID-19 vaccine makers today, especially in connection with the seasonal flu. What’s even odder, though, is that despite this terrible news, some vaccine makers’ stocks actually managed to go up.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

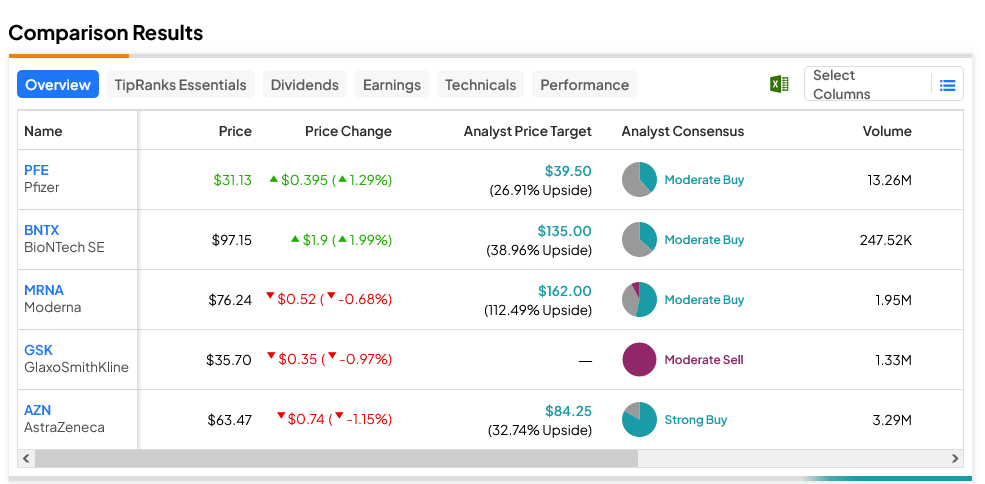

Both Pfizer (NYSE:PFE) and BioNTech (NASDAQ:BNTX) gained, up 1.29% and 1.99%, respectively. Meanwhile, Moderna (NASDAQ:MRNA) and GlaxoSmithKline (NYSE:GSK) lost fractionally in Thursday afternoon’s trading. The hardest hit was AstraZeneca (NASDAQ:AZN), which lost just over 1%.

The issue that caused a hit for these vaccine stocks was a recently released study from the Food and Drug Administration (FDA) in the U.S. That study damaged a recently-launched narrative about being able to take the flu shot at the same time as the COVID-19 vaccine.

Specifically, those older adults who take their flu shot and their COVID-19 bivalent vaccines together have a higher risk of stroke. This study examined the results from over 5.3 million people aged 65 or older on Medicare and discovered that there’s a slight increase in the risk of getting a stroke.

Interestingly, the study noted that there was no increased risk of stroke after just getting the COVID-19 shots. However, when coupled with the flu vaccine, that made the increased stroke risk kick in. This result also coincides surprisingly well with word out of the FDA from back in September.

Dr. Peter Marks—director of the Center for Biologics Evaluation and Research with the FDA—noted that, while patients could get the flu and COVID shots on the same day, it would likely be better to space them out due to a potential for a small fever or similar issues. The possibility of a stroke never came up, but now, it might have to.

What are the Top Companies that Produce Vaccines?

Turning to Wall Street, MRNA stock remains the leader in upside potential here. This Moderate Buy-rated stock offers 112.49% against its average price target of $162. Meanwhile, with an average price target of $39.50, PFE stock is the laggard, as this Moderate Buy-rated stock offers investors 26.91% upside potential.