In March, after two years of burning through cash to successfully launch a social media company with its brand new Truth+, a TV streaming platform. Trump Media & Technology Group (DJT) went public in a deal with SPAC Digital World Acquisition Corp. It didn’t take long for the shares to jump to an intraday trading high of nearly $80. Since then, the stock has shed over 60% on a volatile ride downward. For now, the future of this initiative looks very much up in the air.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Despite its high-profile launch, the company faces significant financial challenges, with a reported $16.4 million operating loss in Q2 2024. Critics suggest the modest $837,000 revenue generated during the same period reflects the difficulty in scaling the business.

In addition, it seems that Donald Trump’s political fortunes influence the stock more than the company’s financial health. However, TMTG’s trajectory mainly relies on how the public perceives Trump. Reelection to the presidency of the U.S. would likely catalyze the shares significantly higher, while a defeat could translate to a downward spike.

Nevertheless, despite the backing of a notable personality, investors should keep an eye on DJT’s ongoing financial struggles. These underscore the uncertainty surrounding its stability and future growth and the possibility of selling pressure if Donald Trump decides to start liquidating some of his shares (he owns nearly 60%) when his lockup period expires in September.

TMTG’s Emerging Media Empire

Trump Media & Technology Group Corp. is a social media and technology company. Its brands include TRUTH Social, TMTG+, and TMTG News.

The company has recently initiated the phased launch of its TV streaming platform, Truth+, transitioning from existing beta testing of its linear TV streaming to its new content delivery network. Once operational, a Truth+ icon on the Truth Social platform will allow users to access the new service, which features news, commentary, weather, and lifestyle and entertainment channels.

Trump Media & Technology Group plans to launch streaming apps integrated with Truth Social in successive phases. Initially, the streaming service will be available to all Truth Social users online, followed by its rollout on Android and iOS platforms. The company expects total control over its tech delivery stack for streaming across its private network content delivery network, consistent with making the service “uncancellable” by Big Tech.

TMTG’s Recent Financial Results & Outlook

The company recently published its Q2 2024 financial results. Revenue for the quarter was $836,900, a decline from $1.2 million the same quarter last year. The company reported a GAAP net loss of $16.4 million for the quarter, primarily driven by legal expenses related to the merger with Digital World Acquisition Corp and IT consulting and software licensing costs. The firm reported a loss per share of -$0.10 overall.

The company reported a significant increase in cash and cash equivalents, from $2.6 million the previous year to $344 million, and reported no debt. Despite the reported net loss, management maintains optimistic projections for the future, hailing the launch of the new TV streaming service, developed through a software licensing agreement, as a critical turning point for future revenue generation.

Is DJT Stock a Buy?

Currently, no Wall Street analysts have published ratings or price targets on the stock, leaving it to the animal spirits of market participants to sort out. Shares of the company have been on a tumultuous ride since going public in March, and there is no sign of that volatility residing anytime soon.

Furthermore, the valuation of the shares has no underlying fundamentals, such as sporting an astronomical P/S ratio of 782.98x compared to the Internet Content & Information industry average of 5.97x, or a Price to Book Value nearly triple the average of its industry peers.

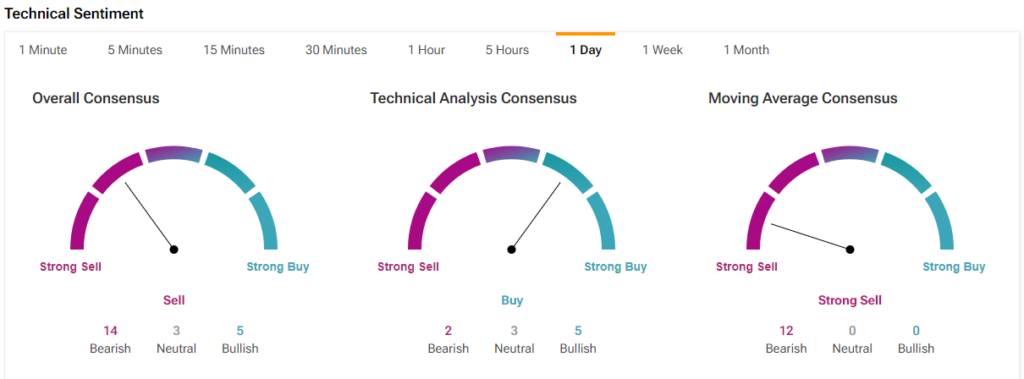

Technical indicators are mixed, but the stock shows negative price momentum, trading below its 20-day (29.67) and 50-day (33.63) moving averages.

The stock appears to have become a proxy for politics and perhaps a funding vehicle for its namesake. It is purely driven by speculation and the political zeitgeist of the moment. Buyers beware.

Final Thoughts on DJT

Since going public in March, Trump Media & Technology Group has faced ongoing financial challenges. Despite these obstacles and a volatile market ride, the company’s financial future might be heavily influenced by the rollout of its new streaming service, Truth+, as part of its growing tech empire. In the short term, expect speculative trading and valuation tied to political developments. However, potential long-term investors may want to keep a keen eye on the budding media empire to see if it can survive and develop beyond this November election cycle.