MicroStrategy (MSTR), famous for its relentless Bitcoin buying spree, just hit the pause button. Michael Saylor, the firm’s executive chair, announced on Feb. 3 that the company now holds 471,107 Bitcoin—worth roughly $30 billion—after 12 weeks of consistent acquisitions. However, the buying frenzy is now on hold, with no stock shares sold or Bitcoin bought since Jan. 27.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Bitcoin Dips amid Trade Tariff Chaos

Bitcoin briefly dropped below $100,000 over the weekend after U.S. President Donald Trump imposed new tariffs on China, Mexico, and Canada. Markets didn’t take kindly to the news, causing a temporary sell-off. The price later bounced back above $98,000 after Mexico’s president reached a deal to delay the tariffs for a month.

MicroStrategy Leads the BTC Reserve Trend

Since its initial $250-million Bitcoin purchase in 2020, MicroStrategy has been the poster child for corporate crypto investment. Other companies like Rumble (RUM) and MARA (MARA) have followed suit, stockpiling Bitcoin as a hedge against inflation. Even governments are exploring similar strategies, with Trump’s latest executive order pushing for a U.S. Bitcoin reserve study.

MicroStrategy may have paused, but it’s still “hodling” strong.

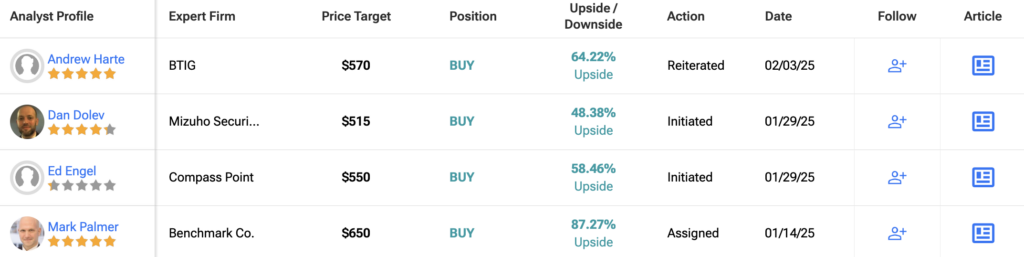

Is MSTR Stock a Good Buy?

Turning to Wall Street, MSTR stock has a Strong Buy consensus rating based on nine unanimous Buys assigned in the last three months. At $557.50, the average MicroStrategy price target implies a 60.6% upside potential. Shares of the company have gained more than 600% in the past year.