Cloud stock MicroStrategy (NASDAQ:MSTR) isn’t so much known for what it does as for what it owns. What it owns is a stock of Bitcoin (BTC-USD) so massive that, for a while, movement in the cryptocurrency—in either direction—prompted movement in the share price. And now, MicroStrategy is down just over 2% in the closing minutes of Thursday’s trading session thanks to a big new buy in Bitcoin.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

MicroStrategy bought up a hefty slug of Bitcoin, bringing in 16,130 tokens, which cost the company a whopping $593.3 million. That was close to a 10% overall increase, reports noted, as the company now holds 174,530 Bitcoin at an average price of roughly $30,200 per Bitcoin. Given that Bitcoin currently is trading around $37,762 per coin, MicroStrategy’s purchase might be considerd a sound strategic move. It’s unclear what it plans to do with all that Bitcoin, but one thing is clear: it’s not looking to sell them any time soon.

MicroStrategy is Actually Planning to Buy More Bitcoin

So, how do we know that MicroStrategy isn’t planning to sell those Bitcoin? Simple—they’ve already announced plans to buy more. And in a strange move, MicroStrategy has set up a deal with BTIG, Canaccord Genuity, and Cowen and Company to arrange a new stock sale. The sale, valued at up to $750 million, will be used for repurchasing debt, providing working capital, and, yes, buying more Bitcoin. Reports note that MicroStrategy’s particularly bullish Bitcoin stance was enough to push it to a two-year high just recently, with shares closing above $500 per share at one point. It’s slipped a bit since then, but it’s actually within striking distance of going for a whole new high.

Is MicroStrategy a Buy Right Now?

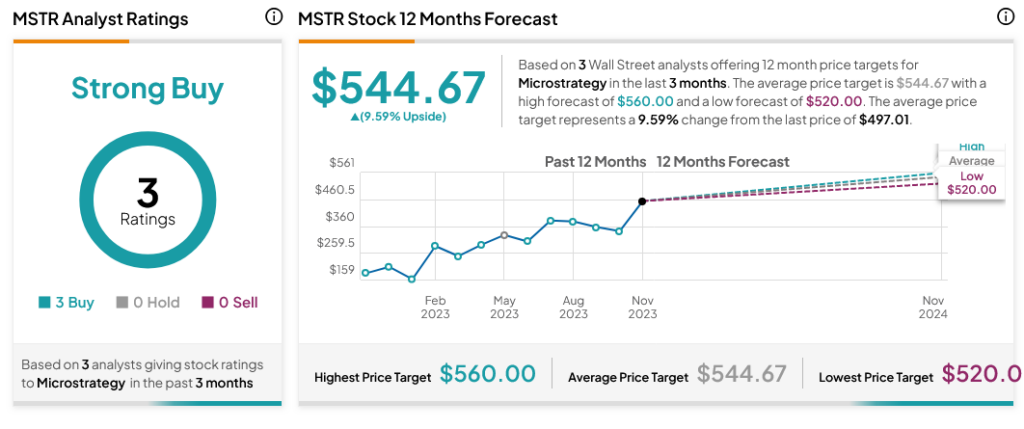

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSTR stock based on three Buys assigned in the past three months, as indicated by the graphic below. After a 149.5% rally in its share price over the past year, the average MSTR price target of $544.67 per share implies 9.59% upside potential.