MicroStrategy (MSTR) is rapidly advancing toward its ambitious goal of raising $21 billion through stock sales to fund its Bitcoin (BTC-USD) purchases. Just a month after unveiling this strategy, the business intelligence company turned crypto giant has already secured around 50% of its target, according to Bloomberg.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In the past week alone, MicroStrategy sold 3.7 million shares, using the proceeds to buy $1.5 billion worth of Bitcoin. This marks the company’s fourth consecutive weekly BTC purchase.

MSTR Has $11.3B Remaining in Stock Issuance

According to Bloomberg, the company now has approximately $11.3 billion remaining in stock issuance under its at-the-market share program. This type of offering allows a company to raise capital by selling secondary shares after going public. Additionally, MicroStrategy plans to raise another $21 billion through fixed-income securities by 2027, steadily increasing these offerings to support its ongoing Bitcoin acquisition strategy.

In a recent filing, MicroStrategy reported acquiring 15,400 Bitcoin at an average price of around $95,976 per token between November 25 and December 1. Since November 11, the company has spent over $13.5 billion on Bitcoin and now holds $38 billion worth of the cryptocurrency.

MSTR Revealed Its “21/21 Plan”

To fund its Bitcoin purchases, MicroStrategy is using a combination of convertible notes and its at-the-market share offerings. Earlier this year, MSTR revealed its “21/21 Plan,” with a goal of raising $42 billion over the next three years to expand its Bitcoin holdings. Of this, $21 billion will come from at-the-market equity raises, while the remaining $21 billion will come from debt.

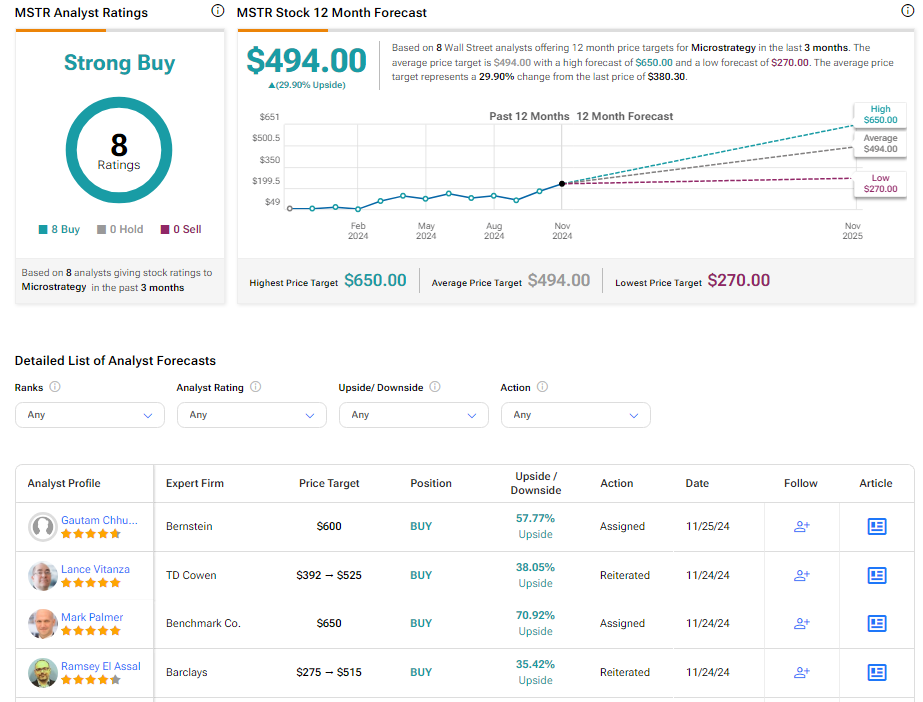

Is MSTR a Good Stock to Buy?

Analysts remain bullish about MSTR stock, with a Strong Buy consensus rating based on a unanimous eight Buys. Over the past year, MSTR has skyrocketed by more than 500%, and the average MSTR price target of $494 implies an upside potential of 29.9% from current levels.