A little bit of search engine skullduggery stepped in today, as reports suggest that Google (NASDAQ:GOOG) may no longer be top dog at Apple (NASDAQ:AAPL) in terms of search. Since Microsoft (NASDAQ:MSFT) upgraded Bing to include AI, there are signs that Apple’s poised to take it a little more seriously. The idea that Microsoft could be the new leading search engine at Apple gave Microsoft a fractional boost in Tuesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In fact, reports suggest that Bing’s modifications might ultimately force Google to pay up to keep its top spot as Apple’s default search system. Interestingly, Google already pays a certain amount to keep its default status intact. Some reports put that number at around $15 billion annually. But as Bing’s popularity increases, Google will likely have to pay more to keep its place so as to replace the revenue that would be lost by making Bing the default instead.

Ross Sandler, an analyst with Barclays, estimates that iOS is responsible for better than half of Google’s operating profit: roughly $46 billion out of its $78 billion annually. Should Bing ultimately become the default, Sandler notes, Google might lose 11% of its income outright. Even if Google lost its default slot in just Europe, the Middle East, and Asia—the EMEA region—that would cost Google about 7% of its annual take.

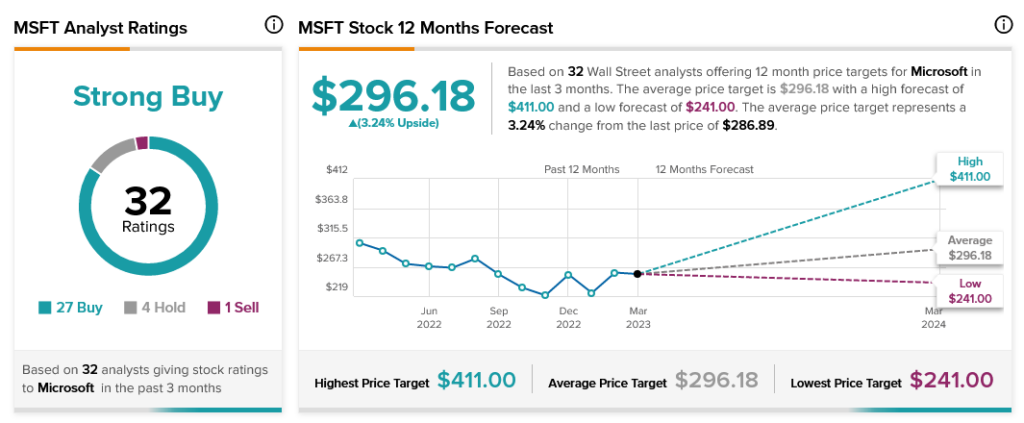

Even as Microsoft threatens Google and its primacy on iOS searches, analysts are still abundantly happy with it. Analyst consensus calls it a Strong Buy. With Buy recommendations outrunning Hold and Sell recommendations combined by better than five to one, it is indeed a strong buy. But Microsoft stock’s upside potential is minimal; it stands at a meager 3.24% thanks to its average price target of $296.18.