Microsoft Corp. (MSFT) announced a $1.5 billion investment plan to set up its first datacenter region in Italy as the U.S. software giant seeks to spread the reach of its cloud computing and digital products and services to more regions and businesses.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Under the investment plan, Microsoft plans to provide access to local cloud services; expand its partnership with Poste Italiane, Italy’s largest service distribution network; launch digital skilling and smart-working programs; and accelerate access to artificial intelligence programs for businesses.

“This plan will support those working across the country to sustain and rebuild businesses, to explore new entrepreneurial opportunities and help solve some of the country’s most difficult challenges, all while meeting critical security and compliance needs,” said Jean-Philippe Courtois, executive vice president and president of Microsoft Global Sales, Marketing and Operations. “We see enormous potential to accelerate innovation within the national ecosystem through cloud services, AI and digital skilling.”

Microsoft has a nearly 35-plus-year track record of working with Italian organizations and businesses of all sizes, and already boasts a network of more than 10,000 local partners. The move comes after last week’s announcement of a $1 billion seven-year investment plan to accelerate innovation and digital transformation in the “Polish Digital Valley.”

The datacenter region in Italy is slated to generate more than 10,000 job opportunities and an estimated $9 billion in direct and indirect business impact by the end of 2024, according to joint research conducted by Microsoft Italia and Politecnico di Milano School of Management. The forecast takes into account the datacenter construction and operations as well as opportunities for businesses and the technology ecosystem.

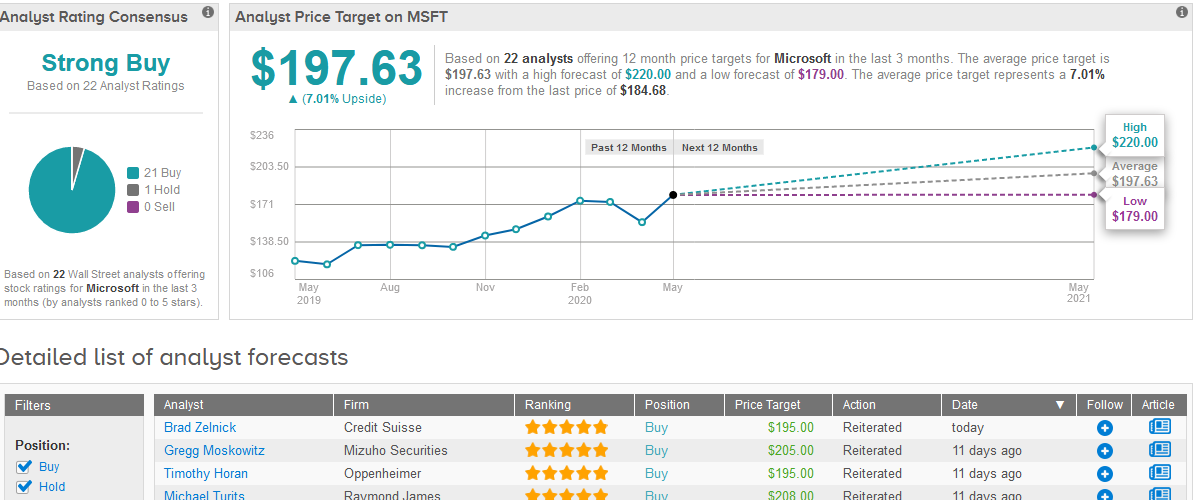

Wall Street analysts have a Strong Buy consensus rating on the company’s stock based on a stellar 21 Buys and 1 Hold rating assigned in the last three months. The $197.63 average price target provides investors with 7% upside potential in the shares should it be met in the coming 12 months. (See Microsoft stock analysis on TipRanks).

Related News:

AMC Pops 11% Amid Potential Acquisition Talks by Amazon

ON Semiconductor Quarterly Earnings Miss Amid Virus Pandemic, Sees Orders Coming Back

Seres Therapeutics Reports Weak Earnings, But Significant Upside Lies Ahead