Tech giant Microsoft (MSFT) recently ran afoul of a major issue in artificial intelligence (AI) infrastructure: a lack of electricity. In fact, reports noted, Microsoft currently has more AI chips in its inventory than it has access to electricity to run them. The news did not sit well with investors, as shares slipped modestly in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The word came from Satya Nadella himself, who revealed that the problem was not a lack of chips to run AI functions on, but rather, a lack of sufficient electricity to power them up. Thus, Microsoft currently has an inventory of chips just waiting for sufficient kilowatts to actually run and do their jobs.

This is not limited to Microsoft, as several reports have emerged noting that tech companies are even going so far as to invest in their own modular nuclear reactors in a bid to generate all the power that will be needed without depending on conventional grid supplies. Conventional grid supplies are already getting a little pressed, and average households are discovering electric costs are on the rise partly because of the growing demand from data centers and AI processes.

Meanwhile On Xbox

In lighter Microsoft news, reports have emerged about the first half of November on the Xbox Game Pass lineup, and with a holiday coming up, there will be plenty of titles to try out. Anyone looking forward to Call of Duty: Black Ops 7 will be happy to know that this is a day one title, and will hit Game Pass immediately on November 14.

Several other titles are also on the way, including Dead Static Drive, Whiskerwood, Voidtrain, Great God Grove, and Lara Croft and the Temple of Osiris. This is just for the first half of the month, too, so Microsoft is certainly offering up a bounty for players to enjoy with the upcoming Thanksgiving holiday.

Is Microsoft a Buy, Hold or Sell?

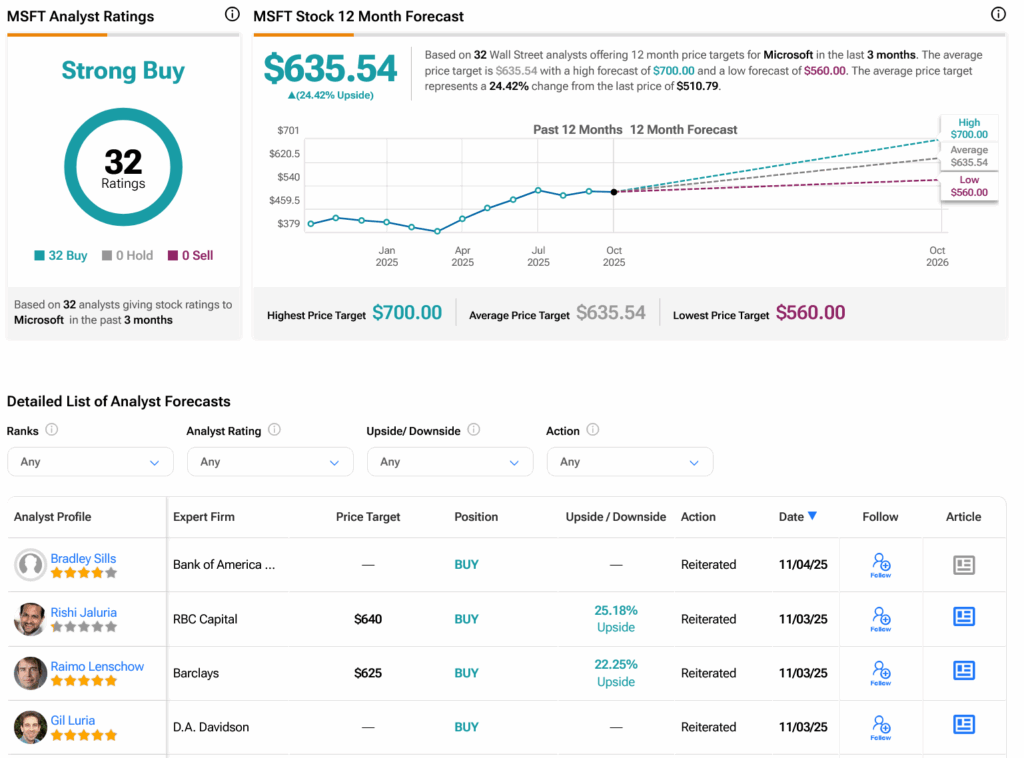

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 32 Buys assigned in the past three months, as indicated by the graphic below. After a 25.66% rally in its share price over the past year, the average MSFT price target of $635.54 per share implies 24.42% upside potential.