We have known for some time that tech companies—and tech giant Microsoft (MSFT) is no exception here—have been looking for new sources of electric power for some time. Developing things like artificial intelligence (AI) takes a lot of juice, and with carbon footprints still an issue to some degree, businesses want to buy in on clean energy production. Microsoft recently expanded a deal it made with Shizen Energy Inc. to produce new clean electricity, and investors were modestly pleased. Or perhaps fractionally pleased, because that was how much gain Microsoft shares had in Friday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Microsoft has been particularly aggressive in buying clean energy from Shizen Energy, as three solar power purchase agreements have combined to produce a total long-term purchase of 100 megawatts. Microsoft’s purchase history in clean energy goes back quite a ways; since 2020, reports note, its contracted volume of clean power purchases is up fully 18 times.

Microsoft also has a long-term history with Shizen, as it signed previous deals going back to 2023. Shizen itself was founded in 2011 after the Fukushima disaster, and focused on solar and wind power, with around 1.2 gigawatts worth of projects developed before the end of 2024. Most of Shizen’s projects are located in the Chugoku and Kyushu regions in Japan’s western areas.

Fighting the Fallout

Meanwhile, the controversy around Xbox Game Pass continues to escalate, as Microsoft is fighting back against the backlash by declaring it is working on “…adding more value” to the platform. In what may be one of the more tone-deaf responses out of Microsoft, its director of gaming and platform communications Dustin Blackwell declared, “We understand price increases are never fun for anybody.”

And indeed, customers will be getting more for their increased purchase price. Game Pass Ultimate, as the new tier is named, comes with over 400 titles available to it, and more than 75 day one releases annually. That is actually up around half from the day one titles available through 2024. Though considering how many players have canceled outright, that may not be value enough.

Is Microsoft a Buy, Hold or Sell?

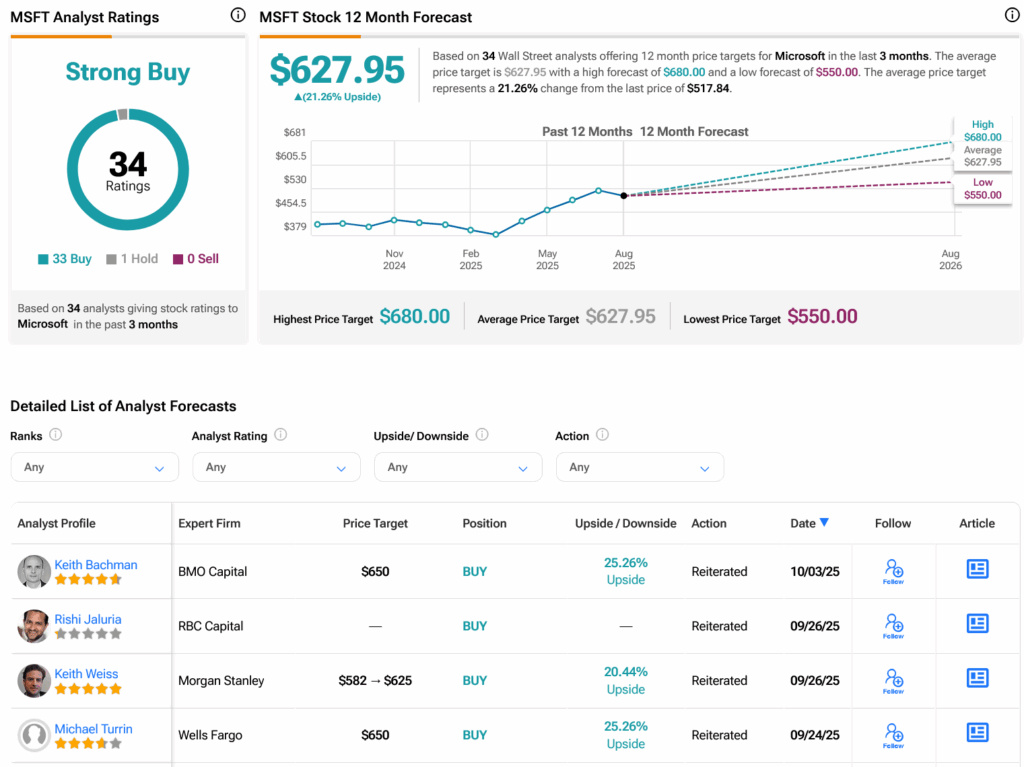

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 33 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 23.96% rally in its share price over the past year, the average MSFT price target of $627.95 per share implies 21.26% upside potential.