Microsoft (NASDAQ:MSFT) released its Fiscal Q3-2024 earnings report last week, which highlighted solid growth rates across most of its verticals. Cloud computing and artificial intelligence are still key growth drivers. The company didn’t produce any eye-popping numbers but had a productive quarter nonetheless, which makes me bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Microsoft Keeps Growing

Microsoft reported 17% year-over-year revenue growth and 20% year-over-year net income growth in Q3 FY2024. Growth rates were slightly higher in Q2 FY2024, with revenue and net income up by 18% and 33% year-over-year, respectively.

Microsoft Cloud was once again the leading force. The segment grew by 23% year-over-year to reach $35.1 billion. That’s more than half of the company’s total revenue.

However, Microsoft Cloud wasn’t the only winner. For instance, Productivity and Business Processes grew by 12% year-over-year. Office Commercial products and cloud services revenue grew by 13% year-over-year, while LinkedIn experienced 10% year-over-year revenue growth.

Search and News Advertising revenue was also a highlight, with a 12% year-over-year gain. While Xbox also delivered a 62% year-over-year increase, most of those gains were fueled by the Activision Blizzard acquisition.

Copilot Is the Future

The allure of Microsoft is that it’s tapping into artificial intelligence without relying on moonshot innovations. The firm already has solid financials, but Copilot can take it to the next level.

CEO Satya Nadella hinted at this development in his press release remarks.

“Microsoft Copilot and Copilot stack are orchestrating a new era of AI transformation, driving better business outcomes across every role and industry,” Nadella stated.

Copilot was launched in November 2023 as “your everyday AI companion.” Copilot has enabled more productivity across the Microsoft ecosystem. You can autogenerate PowerPoint presentations, text, and other resources.

Investors were excited about Copilot when it came out, but the company’s advancement into cybersecurity drew more attention. Microsoft launched Copilot for Security earlier this year to make cybersecurity solutions more accessible for small business owners.

AI Expansion Can Extend Growth Rates

Artificial intelligence has strengthened many company’s revenue and earnings. It was the buzzword for 2023 and this year. However, Microsoft has been making significant moves to corner the industry and substantially increase its market share.

Microsoft’s investment in OpenAI brought more attention to the company’s AI efforts. The company paid $650 million to work with Inflection’s CEO and most of its staff. Inflection is an AI startup valued at $4 billion.

It resembles an acquisition since the company is bringing almost all of the staff from Inflection to work on Microsoft AI projects. However, it’s not the type of acquisition that will draw federal scrutiny like the Activision Blizzard deal.

Tech Crunch offered a term to describe the move: an “acqui-hire.” This circumvention can help Microsoft and its competitors gain more share in the artificial intelligence industry without attracting regulators. The legal gray area presents an opportunity for long-term investors.

Microsoft Continues to Return Value to Shareholders

Microsoft’s vast profits give the corporation plenty of resources to generate additional value for shareholders. The management team went to work and returned $8.4 billion to shareholders in the third quarter of Fiscal 2024.

Investors currently get an annualized dividend of $3.00 per share. Although the dividend yield is below 1%, Microsoft has done a great job with its dividend growth rate. The compounded dividend growth rate currently stands at 10.86% over the past decade.

Is MSFT Stock a Buy, According to Analysts?

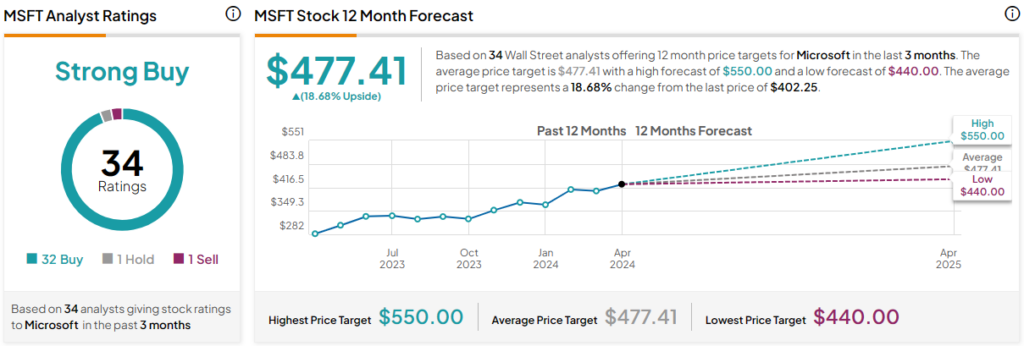

Analysts have been signing praises of Microsoft stock for a while. It’s nothing new for the well-diversified corporation that continues to expand in multiple verticals. The stock is currently rated as a Strong Buy on TipRanks based on 32 Buys, one Hold, and one Sell rating assigned in the past three months.

The average MSFT stock price target of $477.41 implies 18.7% upside potential. However, more gains can be in the cards based on the highest price target of $550 per share. Following the earnings report, analysts have been raising their Microsoft price targets and reiterating their Buy positions.

The Bottom Line on Microsoft Stock

Investors had high expectations for Microsoft, and the corporation delivered. Although revenue and net income growth did not accelerate compared to the previous quarter, both metrics showed respectable year-over-year improvements.

Microsoft’s AI initiatives are working and have helped the company expand its profit margins. Cloud revenue continues to be a significant catalyst, but investors should also monitor Copilot. Leadership has expressed enthusiasm about Copilot’s long-term potential ever since the tech giant announced the first version.

Microsoft stock has been a reliable investment for many years and is a top holding in many funds. It is the largest publicly traded corporation, which makes it the top holding of the S&P 500 (SPX) and the Nasdaq 100 (NDX). Higher price targets from analysts suggest that shares can keep rallying in the longer term.