With its stake in ChatGPT maker Open AI, Microsoft (NASDAQ:MSFT) has positioned itself at the forefront of the AI revolution. The huge opportunity in the emerging field has been central to the bullish sentiment around the company, enabling the tech giant to topple Apple as the world’s largest company by market cap.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

But while most of the focus has been on the AI play, it should be remembered that Microsoft is a multi-pronged beast and has its fingers in many pies. According to Morgan Stanley’s Keith Weiss, an analyst ranked in the top 2% of Street pros, there’s one area in its business that is not being given its fair do’s.

“Microsoft remains the cybersecurity leader with a large installed base and broadening platform addressing multiple product categories,” says the 5-star analyst. “With an estimated $25 billion in revenue, up 25% YoY, and >1 million customers, we believe security remains an underappreciated source of growth for Microsoft and estimate >$30 billion in revenue by FY25 (11% of total revs).”

Weiss sees several areas that are likely to drive further share gains. Driven by organizations seeking cost savings and improved security results, Weiss expects a growing need for “vendor consolidation.” “With the average enterprise deploying >50 different security tools, we see opportunity for consolidation towards platforms like Microsoft,” the analyst explained.

Secondly, the tech giant has substantial and expanding investment capabilities; Microsoft’s annual spend of over $5 billion on security, encompassing both product development and go-to-market strategies, surpasses that of all its peers in the security software sector.

Thirdly, Microsoft Security Copilot is strongly positioned to provide AI-driven automation for enterprise security. It harnesses over 78 trillion daily threat signals and extensive datasets from Microsoft’s security product portfolio, covering endpoints, identity, email, and data protection.

With the security segment now “much larger in scale,” Weiss believes it constitutes an increasingly vital element driving sustained mid-teens growth for Microsoft’s overall revenue. “Bottom line,” the analyst summed up, “as security remains a top priority for enterprises, we believe Microsoft is well positioned to capture incremental market share.”

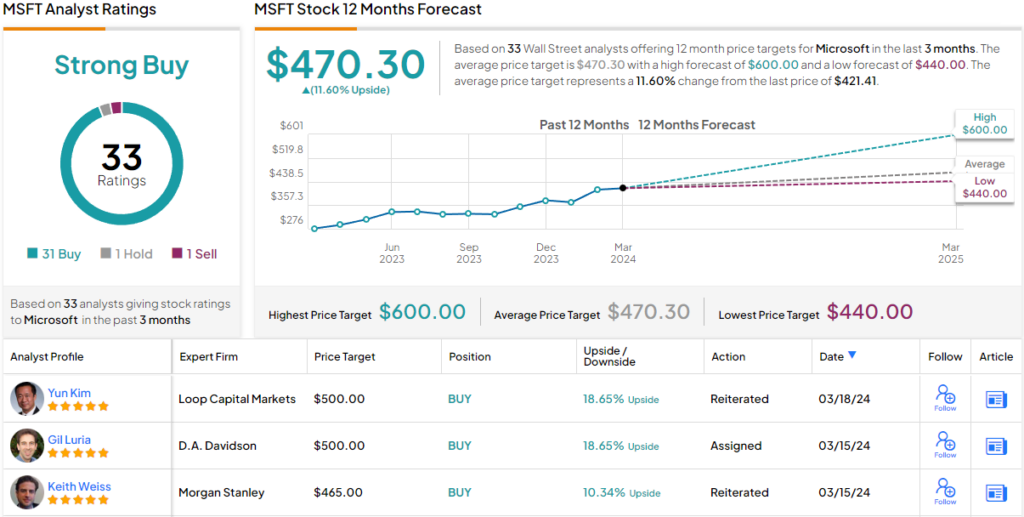

All told, Weiss rates Microsoft shares as Overweight (i.e., Buy) while his $465 price target suggests the stock is primed for one-year returns of 12%. (To watch Weiss’s track record, click here)

Over the past 3 months, 33 analysts have chimed in with MSFT reviews and these break down into 31 Buys and 1 Hold and Sell, each, all coalescing to a Strong Buy consensus rating. Going by the $470.30 average price target, a year from now investors will be pocketing gains of ~12%. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.