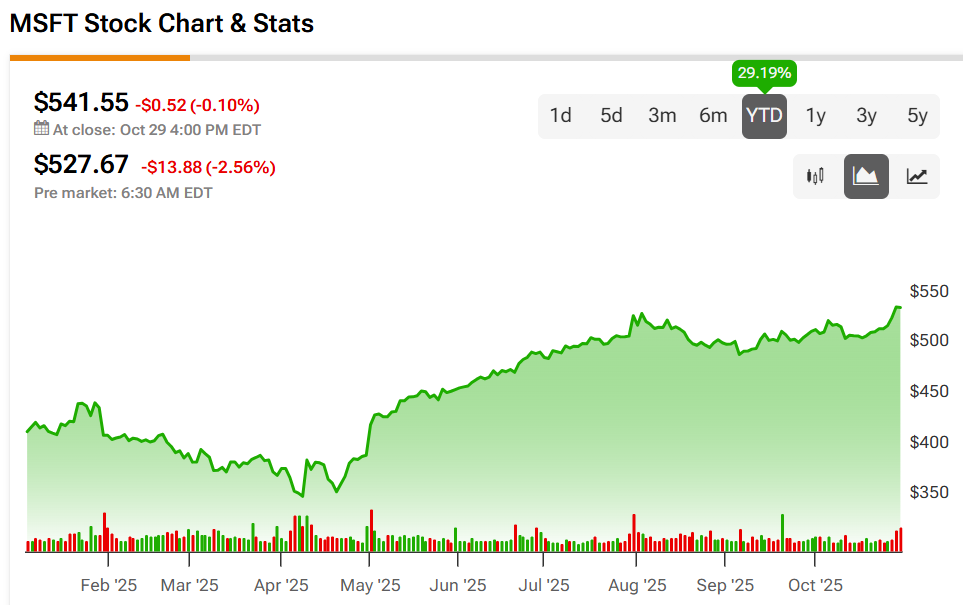

Microsoft Corporation (MSFT) posted strong first-quarter fiscal 2026 results, topping Wall Street estimates but sending its share price down. The stock fell nearly 4% in after-hours trading as investors weighed the cost of its fast-growing artificial intelligence investments.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company reported adjusted earnings of $4.13 per share on revenue of $77.7 billion, both above forecasts. Revenue rose 18% year-over-year, powered by another strong performance in its Azure cloud business, which grew 40%. Microsoft’s Intelligent Cloud division brought in $30.9 billion, up 28% from last year.

AI Spending Raises Concerns

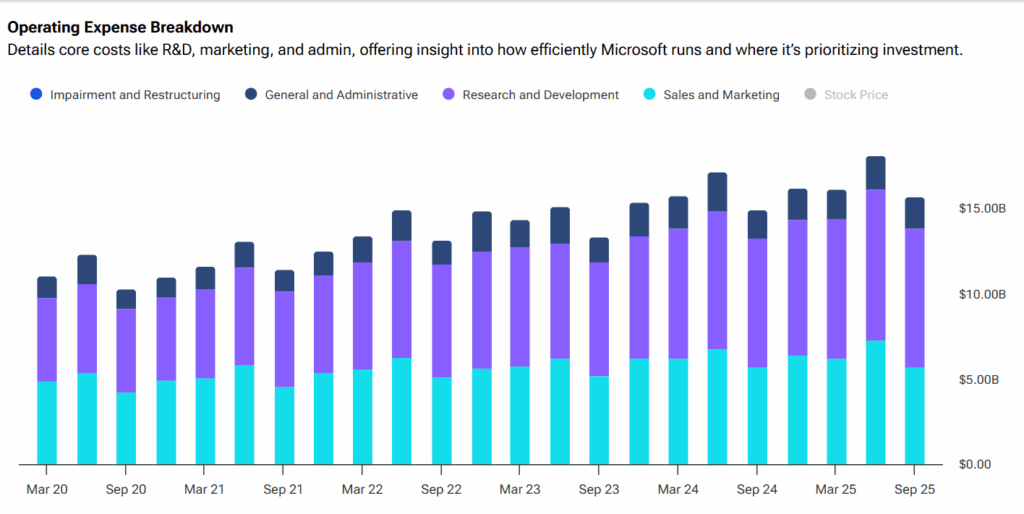

Although growth remained solid, Microsoft’s rising AI spending weighed on sentiment. The company said capital expenses jumped 74% to almost $35 billion, with about half going toward AI infrastructure. Executives also warned that spending will continue to rise through 2026 as the company builds capacity to meet demand.

Microsoft’s $13 billion investment in OpenAI (PC:OPAIQ) also took a toll this quarter. The company recorded a $3.1 billion accounting loss from the stake, cutting earnings per share by $0.41. Microsoft holds a 27% share in the AI startup, which is now valued at around $135 billion.

For now, investors seem focused on the near-term cost rather than the long-term payoff. While Azure and cloud services continue to grow, the question remains how quickly Microsoft can turn its massive AI spending into higher profits.

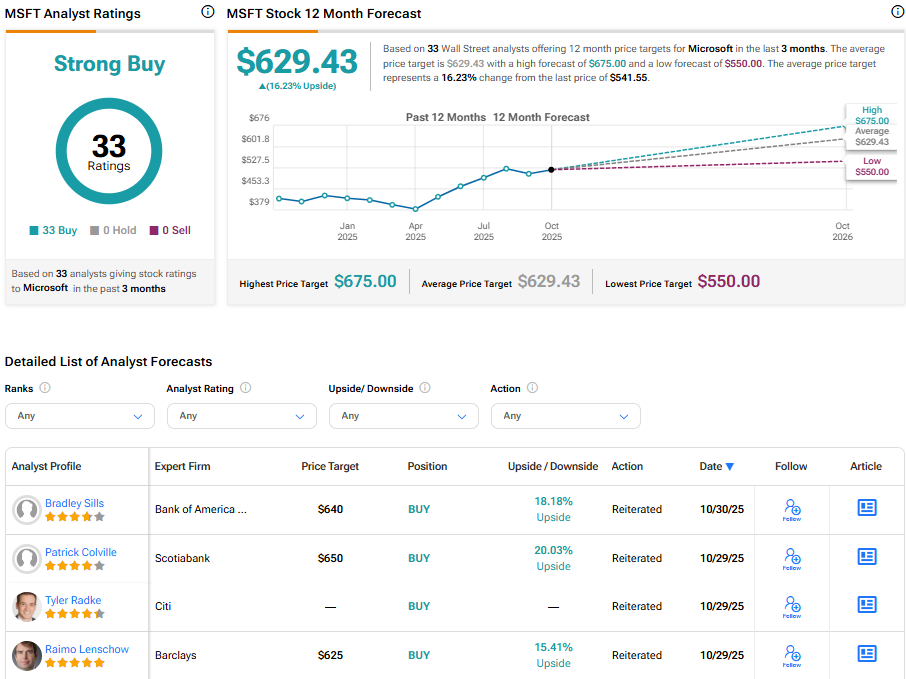

Is Microsoft Stock a Buy, Sell, or Hold?

Despite the slight decline, Microsoft continues to hold a Strong Buy consensus among the Street’s analysts, with all 33 analysts rating it a Buy. The average MSFT stock price target stands at $629.43, implying a 16.23% upside from the current price.