By now, it’s clear that AI is more than a flash in the pan, and more than just a trend. It’s the next new thing, and we’re all present at the creation – better yet, we can all see that. What’s being created isn’t fully clear yet; the ways that AI will impact the world are still hovering at the edges of our peripheral vision.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

But the technology is here to stay, and KayBanc analyst Jackson Ader lays out what that means for investors: “Whether we look at share price performance or the actual dollars of revenue on the board, AI’s goodness is, thus far in the cycle, really concentrated in a few companies. We turned the concept of ‘data gravity’ upside down to show a framework for where different companies and subsectors may fall as AI dollars begin to proliferate and disperse down the rungs of the pyramid. We then take a look at what we view as the three main monetization models for generative AI and provide our opinion on the relative attractiveness.”

“In short,” says Ader, “we are in favor of the toll-collector firms that will benefit from the continued shift in workloads to the cloud, those firms that can directly charge customers money for use of AI application SKUs, and if generative AI is not core to the value proposition or simply embedded into the existing product set for little additional cost, we are skeptical of the benefits.”

Running forward with this, the analyst goes on to look at Microsoft (NASDAQ:MSFT) and Adobe (NASDAQ:ADBE), two key tech giants that are heavily involved in the development and deployment of AI technologies. Using the latest data, Ader works to divine the future for each of them, to pick out the superior AI stock to buy. Here’s a closer look at what he’s found.

Microsoft

The first AI stock in the KeyBanc analyst’s sights is Microsoft, one of the world’s oldest personal computing companies. Talk about being ‘present at the creation;’ Microsoft has its roots in the first years of the PC revolution, in 1975, and has built itself into an essential player in software and software development. Windows is the world’s most used operating system, and the Office software package has become ubiquitous in workplaces worldwide.

Building that position, and that dominant market share, has brought enormous rewards to Microsoft. The company is the world’s largest publicly traded firm, with a market cap of ~3.2 trillion, and annual revenues exceeding $211 billion in its last full fiscal year, 2023.

Microsoft hasn’t let its success stand still on Windows and Office; the company has been a leader in the development and use of AI technology. We all know about OpenAI’s release of ChatGPT, the generative AI chatbot that sparked off this latest wave of interest in the tech back in November of ’22; Microsoft is a long-time investor in OpenAI, and has been since 2019.

Backing AI has also been good for Microsoft. The software firm has been able to integrate generative AI into its Bing search engine, and the latest versions of Windows and Office now come with an AI-based online assistant, Copilot.

Microsoft is also a heavy hitter in cloud computing and has been integrating AI into its Azure cloud platform for several years. Merging AI with Azure makes the cloud platform more competitive with its peers, AWS and Google Cloud, and adds value to the 200-plus software tools and products available to Azure subscribers. The cloud platform is one of Microsoft’s more important revenue drivers. Azure is a major component of Microsoft’s Intelligent Cloud, which saw its revenues hit $25.9 billion in the second quarter of 2024, representing a 20% year-over-year increase.

Overall, the company’s revenue in the second quarter totaled $62 billion, marking an 18% year-over-year gain and surpassing expectations by $890 million. Quarterly earnings stood at $2.93 per share, exceeding the forecast by 16 cents per share.

Checking in with KeyBanc’s Ader, we find that the analyst is bullish on Microsoft’s AI exposure, writing: “Between Azure and the suite of copilots being rolled out across Office and elsewhere in the product portfolio, Microsoft sits in the catbird seat in two of the three main ways software vendors can monetize the AI wave. We are unfazed by the recent debate around Azure’s growth mix between AI and non-AI as we see AI’s rise in the revenue stream as a positive symptom of the Company’s strength in the public cloud space.”

“2023 was the first year Azure added the plurality of the growth in public cloud spend, and we expect that trend to continue. We are wary of the perma-cycle of capex investment to support Azure but expect the growth in capital expenditures to moderate through 2026 and lead to an acceleration in free cash flow growth. Between the scarcity of investible assets with tangible AI exposure and the rarity of being able to own Microsoft as a growth company among its large cap peers, we believe paying today’s premium multiple is worth the price,” the analyst added.

Ader’s comments back up his Overweight (i.e. Buy) rating on MSFT, while his $490 price target points toward a 14% upside for the coming year. (To watch Ader’s track record, click here)

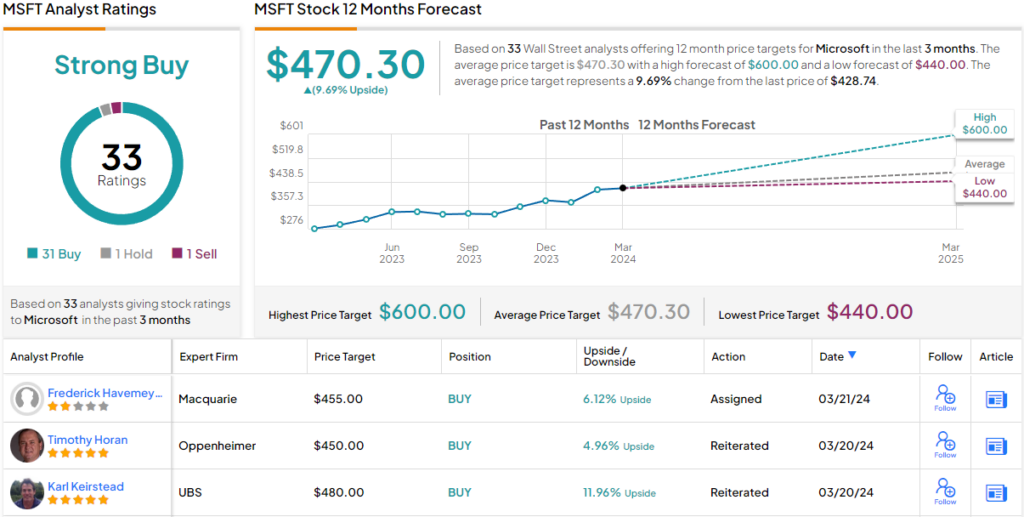

The Street’s general view is bullish on Microsoft, too, as is clear from the 33 recent analyst reviews of the stock. These break down to 31 Buys and 1 each to Hold and Sell, for a Strong Buy consensus rating. The stock is priced at $429.37 and the $470.30 average target price suggests a 12-month gain of 9.5%. (See Microsoft stock forecast)

Adobe

The second AI stock we’ll look at is another of the world’s major software companies, Adobe. This company has long held an industry-leading position in the area of content creation and publishing, and it was the inventor of the .PDF format that allows easy transfer and reading of documents without risk of corrupting text or images.

Adobe’s major product today is the Creative Cloud, a full-service package of software tools that are popular with graphic designers, content editors, and online publishers. The Cloud is made up of numerous applications, including Photoshop, Illustrator, InDesign, Acrobat, and Premiere Pro, and is available through the popular ‘as-a-Service’ subscription model. Subscribers will also have access to Adobe’s libraries and resources, including fonts and images. All of this has made Adobe a one-stop shop for online creative specialists.

Tools like Illustrator and InDesign are great, but they are targeted at specialists, experienced graphic designers. Casual users may find them difficult to use. Adobe has moved to address that issue with its new Firefly application, designed to bring generative AI to the content creation sphere.

Firefly was first launched in March of 2023 and is currently in the public beta-test phase. Potential users can access Firefly online through Adobe’s website, where they can register an account. This account allows them to generate professional-quality images using simple natural language prompts. Firefly is billed by the company as a new tool for creatives at all levels.

Adobe’s success in developing quality products and building itself into an indispensable creative tool has been reflected in the company’s financial results. In the last reported quarter, fiscal 1Q24, Adobe reported record-level quarterly revenues of $5.18 billion. This was up more than 11% year-over-year and beat the forecast by $30 million. At the company’s bottom line, the non-GAAP EPS of $4.48 was 10 cents per share better than had been expected.

Looking ahead, Adobe finished Q1 with ‘remaining performance obligations’ of $17.58 billion, a good omen for future business. However, the company’s fiscal Q2 revenue guidance was set slightly below the consensus expectation; the company predicted $5.25 billion to $5.30 billion, compared to expectations for $5.31 billion. This guidance, combined with worries about the pace of AI monetization and the strength of the competition in the AI field, was enough to push the stock down to a 16% year-to-date loss.

Watching Adobe for KeyBanc, analyst Ader sees the company’s combination of high value and entry into the competitive AI field as detrimental to the risk-reward. He writes: “Between generative AI and the emergence of strong low-end tools, we expect competitive pressure to rise in the coming years and to slow Creative Cloud growth to the high single digits, which will increasingly be dependent on pricing. The launch of Firefly helps the Company stave off AI threats, but the onslaught of text-to-image and text-to-video products being released into the market has renewed the narrative that AI is increasingly a competitive threat.”

“Add this to the double-edged sword of already stellar margins and a premium valuation relative to its growth profile and peers, and our thesis balances out to more risk than reward,” Ader summed up.

To this end, the analyst puts an Underweight (i.e. Sell) rating on ADBE, along with a price target of $445, implying a one-year downside of ~11%.

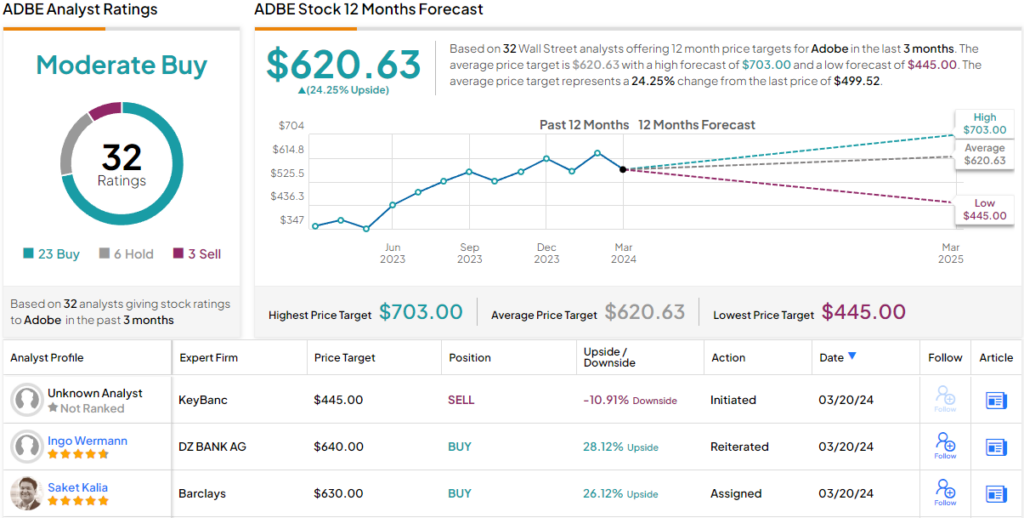

However, the broader sentiment on Adobe remains more optimistic. With a consensus rating of Moderate Buy, based on 23 Buy recommendations, 6 Holds, and 3 Sells, and an average price target of $620.63, the Street anticipates a potential one-year gain of ~24% from the current trading price of $499.52. (See Adobe stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.