Technology giant Microsoft (NASDAQ:MSFT) is taking one more step towards curbing costs and streamlining operations. After laying off roughly 10,000 employees this year, Microsoft has now decided not to offer salary increases to permanent employees. The company will only give promotions, bonuses, and stock awards as additional compensation.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The chaotic macro backdrop and changing consumer behavior have slowed demand for the company’s offerings. Having said that, the developer of the Microsoft Cloud, Binge, LinkedIn, and Office 365 suite has several tricks up its sleeve. One of the most important ones is the pending Activision (NASDAQ:ATVI) acquisition, which is being touted as anti-competitive by the EU watchdog. And second, the artificial intelligence (AI)-related ChatGPT race into which the company is pouring billions of dollars.

Lastly, Microsoft is also betting on the future of fusion power. The company struck a commercial deal with Open AI founder Sam Altman, who founded Helion Energy. As per the deal, Helion will generate and sell at least 50 megawatts of electricity to Microsoft using fusion power by 2028. If Helion fails to meet the timeline, it will pay financial penalties to Microsoft. Fusion power is the latest buzz in the clean energy circle, as it has the potential to produce huge amounts of carbon-free power.

Fusion power has not yet been generated, and Helium will be the first on the market if it is successful in building the power plant. It is building a prototype that could demonstrate fusion power generation by next year. Altman has poured $375 million into Helion Energy and is hopeful of an incredible success story similar to the ChatGPT frenzy.

Commenting on the deal, Brad Smith, President of Microsoft, stated that AI, fusion power, and quantum computing are the biggest innovations currently, with fusion power expected to generate the huge amounts of energy required to run both AI and quantum computing.

Is MSFT a Good Long-Term Investment?

Based on the progress the company is making on ground-breaking technology, MSFT does seem like a good, long-term investment. On May 9, Bernstein analyst Mark Moerdler reiterated a Buy rating on MSFT with a price target of $342 (9.5% upside potential). Moerdler believes that Microsoft’s AI and machine learning “could double Microsoft Cloud revenue” and that the “green shoots are becoming visible.”

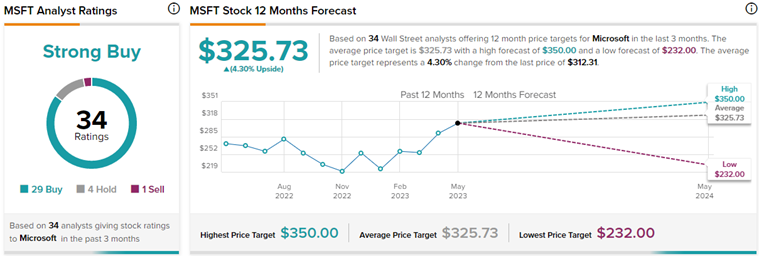

Wall Street analysts are also highly optimistic about the stock’s trajectory. On TipRanks, MSFT commands a Strong Buy consensus rating based on 29 Buys, four Holds, and one Sell rating. The average Microsoft price target of $325.73 implies 4.3% upside potential from current levels. Meanwhile, MSFT stock has gained 30.7% so far this year.