The saga of Microsoft (NASDAQ:MSFT) and OpenAI has proven to be one on par with any of the strangest of Grimm’s Fairy Tales. But according to Wedbush analysts, there’s one story that’s a real match for what’s going on herein: Cinderella. That comparison won Microsoft some points with investors, and they responded by sending share prices up somewhat in Wednesday morning’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The word came from Wedbush analyst Dan Ives, who recounted the saga with alarming brevity before ultimately declaring the whole thing a “Cinderella ending.” Ives went on to clarify the somewhat baffling statement, declaring that the move to dismiss Sam Altman, hire him at Microsoft, and then see him reinstalled as CEO of OpenAI would, ultimately, somehow, make OpenAI stronger. Plus, Ives declares, it would also make the connection between Microsoft and OpenAI stronger, making Microsoft CEO Satya Nadella seem like “…the bedrock in backing Altman.” With Microsoft owning a 49% stake in OpenAI right now, looking solid likely takes on a particular importance to Microsoft.

More Than Just C-Suite Drama

While the impact of Microsoft’s C-suite drama might be dubious at best, there’s plenty more going on. In fact, Microsoft recently got together with Eviden, part of the Atos Group, to augment the use of generative AI. Which is, of course, most of what OpenAI is all about. The new connection with Eviden, reports note, will help other clients take advantage of the Azure OpenAI service, as well as move to the cloud in general, among other functions. Plus, Microsoft and Eviden will work together to both create new Generative AI tools and develop current ones, backed up by Eviden’s force of over 8,000 data experts spread throughout the globe.

Is Microsoft a Buy or Sell?

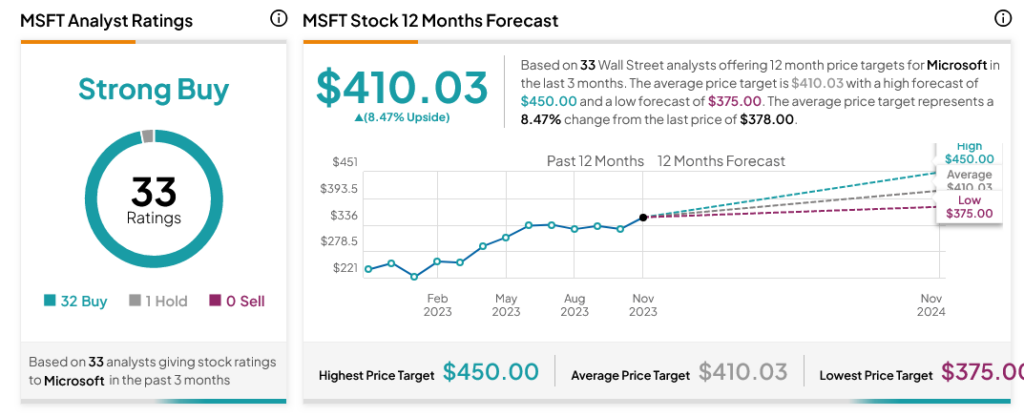

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 32 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 54.05% rally in its share price over the past year, the average MSFT price target of $410.03 per share implies 8.47% upside potential.