Microsoft’s (NASDAQ:MSFT) efforts to address the European Commission’s (EC) antitrust worries haven’t been successful so far, according to Bloomberg. Despite trying to ease tensions by separating the Teams app from its Office product and lowering the prices of some packages, the tech giant hasn’t managed to satisfy the EC. This issue started back in July 2020 when Slack, now owned by Salesforce (NYSE:CRM), accused Microsoft of unfairly tying the Teams app to its popular productivity packages. Now, it seems that the EC might be ready to formally object to Microsoft’s practices, potentially causing further strife for the tech giant.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, Microsoft finds itself facing scrutiny on several other fronts. Recently, Zoom (NASDAQ:ZM) joined the conversation, discussing Microsoft’s bundling tactics with global regulators and encouraging the U.S. Federal Trade Commission to investigate. Moreover, the company is dealing with other complaints filed to the EU, including one about unfair licensing strategies and another concerning the bundling of the OneDrive cloud system with Windows. Adding to Microsoft’s mounting concerns, the EU is considering whether to include Bing, Edge, and their advertising services in the broader regulatory actions under the Digital Markets Act.

What is the Future Price of MSFT Stock?

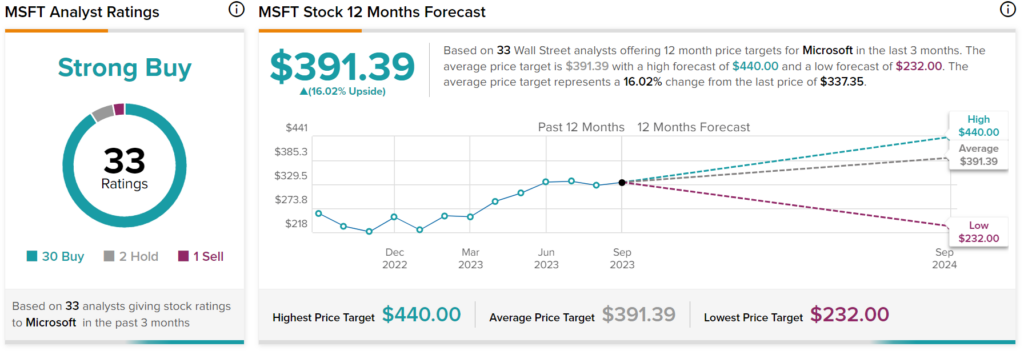

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 30 Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $391.39 per share implies 16% upside potential.