Microsoft (NASDAQ:MSFT)-backed OpenAI is set to release significant updates for developers next month. The updates aim to reduce the cost and time required to develop software applications based on their artificial intelligence (AI) models, Reuters reported. OpenAI is expected to announce the new features, with the ultimate goal of boosting sales, at its first-ever developer conference in San Francisco on November 6, 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

One of the updates includes the addition of memory storage for using AI models, which can cut down on costs for application makers by up to 20 times. In this regard, OpenAI is working on the release of a stateful API (Application Program Interface), which will allow storage of the conversation history of inquiries.

Furthermore, OpenAI plans to introduce tools, such as a vision API, to enable developers to build applications that can analyze and describe images. This tool marks an important step by OpenAI in rolling out multi-modal capabilities, which can process and generate different types of media besides text, including images, audio, and video.

Key Reasons for Updates

It is worth mentioning that the updates aim to attract more developers to the platform for building AI-powered chatbots and autonomous agents capable of automating tasks.

By attracting more developers, OpenAI is targeting to boost sales, as developers will have to pay to access OpenAI’s model to build their own AI software. Last year, the company disclosed expectations of achieving $1 billion in revenue by 2024.

Additionally, the company is reducing the cost of using its platform for developers in an effort to discourage them from exploring alternatives offered by OpenAI competitors, such as Meta Platform’s (META) Llama.

Is Microsoft Stock a Buy Now?

Overall, Microsoft stock has a Strong Buy consensus rating on TipRanks based on 30 Buys and four Holds assigned in the past three months. Meanwhile, the average price target of $397.19 implies 19.5% upside potential. The stock has gained about 40% so far in 2023.

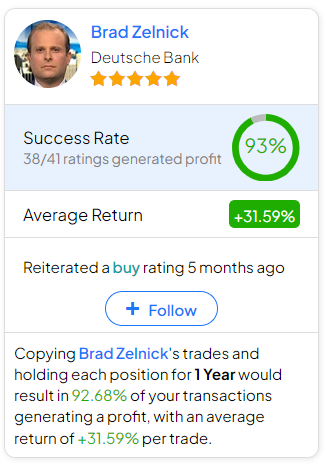

Investors looking for the most accurate and most profitable analyst for MSFT could follow Deutsche Bank analyst Brad Zelnick. Copying his trades on this stock and holding each position for one year could result in 93% of your transactions generating a profit, with an average return of 31.59% per trade.