Once again, the regulatory and antitrust bodies of the European Union are feeling their oats and going after tech stocks Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL) over a whole new issue. The European Commission is seeking information on Bing and iMessage, respectively, to pin down if there really is an issue to begin with. Both Microsoft and Apple shrugged off the effects as investors sent both up fractionally in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The latest issue is whether or not Bing and iMessage qualify as something to be monitored under the terms of the Digital Markets Act in Europe. European regulators sent out a set of questionnaires to not only iMessage and Bing users, but also to users of the Microsoft Edge browser and Microsoft advertising services to determine their statuses as it relates to the act. The questionnaires asked users how important said services were, as well as how those services fit into current ecosystems. Respondents only had days to respond.

The four services involved in the informational gathering may be considered “gatekeepers” under the act, and Microsoft and Apple both fought back against the notion. They noted that none of those four services were sufficiently large or powerful enough to qualify, despite the fact that most of the qualifications are related to company metrics like overall reach and revenue levels. Bing’s tiny share of the search market is likely to protect it, and Apple notes that iMessage doesn’t have anywhere near the 45 million active monthly users required to qualify it under the Digital Markets Act.

Are Microsoft and Apple Good Buys Right Now?

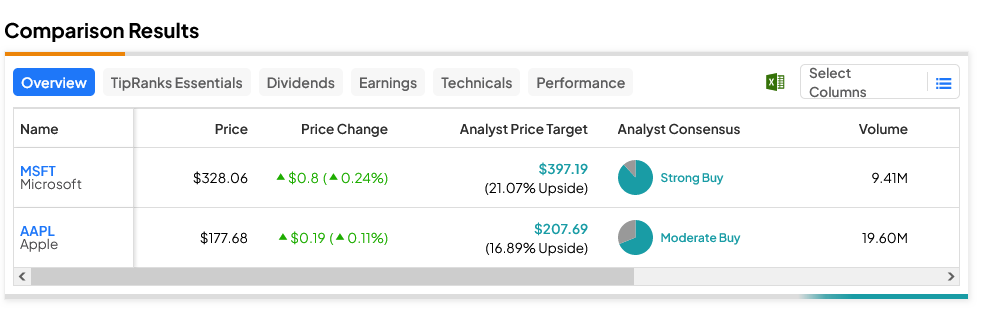

Both Apple and Microsoft are powerhouse companies in the tech space, and it shows. Apple is considered a Moderate Buy, and its $207.69 price tag gives it 16.89% upside potential. Meanwhile, Microsoft is considered a Strong Buy, and it offers 21.07% upside potential thanks to its $397.19 average price target.