Microsoft (MSFT) is facing legal scrutiny in Australia after regulators accused the tech giant of misleading customers with AI-related price hikes for its subscriptions. The complaint accuses Microsoft of adding AI features like Copilot to Microsoft 365, raising prices for millions of users. For investors, the key question is whether this lawsuit is a minor speed bump or the beginning of broader challenges to Microsoft’s aggressive AI monetization strategy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

More Details About the Lawsuit

The Australian Competition and Consumer Commission (ACCC) has taken Microsoft to federal court, alleging the company misled about 2.7 million Australian personal and family plan users when Copilot was added to Microsoft 365 plans starting October 31, 2024.

For context, the company informed customers that Microsoft 365 prices would jump by 45%, telling them they could either accept the higher cost with AI features included or cancel their subscription. The ACCC stated that Microsoft left out a key detail. Users could have kept their lower price by opting out of the Copilot AI tool, yet the company allegedly did not make that choice clear.

Meanwhile, the watchdog says customers only saw the cheaper plan option after they started canceling their subscriptions. It argues that this design hid important information about pricing and gave consumers a misleading view of their choices.

As part of the lawsuit, the ACCC is seeking penalties, refunds for affected customers, and court orders against both Microsoft Australia and its U.S. parent company. Under Australian consumer law, a single breach can carry a maximum penalty of the greater of AU$50 million, three times any financial benefit gained, or up to 30% of the company’s adjusted turnover during the period of the violation if that benefit cannot be calculated.

What This Means for MSFT Investors

For MSFT investors, this case is unlikely to derail the company’s long-term AI growth strategy, though it does highlight rising regulatory scrutiny around how tech companies monetize new AI features. The financial hit could be meaningful if penalties stack up, but the bigger concern is the potential for stricter rules that slow subscription pricing power, one of Microsoft’s key profit drivers.

Overall, the lawsuit looks like a manageable legal hurdle today, with a possibility of broader consequences if it becomes a trend.

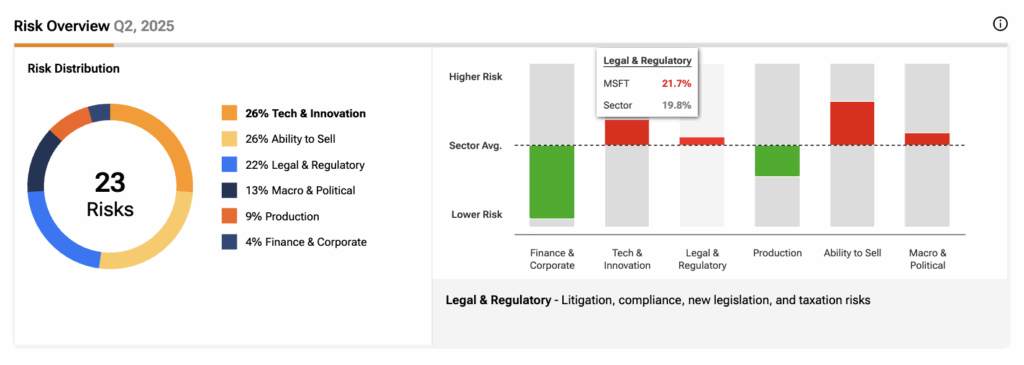

According to TipRanks’ Risk Analysis Tool, legal and regulatory issues made up 21.7 percent of Microsoft’s overall risk profile in Q2 2025. That is notably higher than the broader sector average of 19.8 percent, signaling increased scrutiny on the company’s business practices.

Is it Good to Buy Microsoft Stock Now?

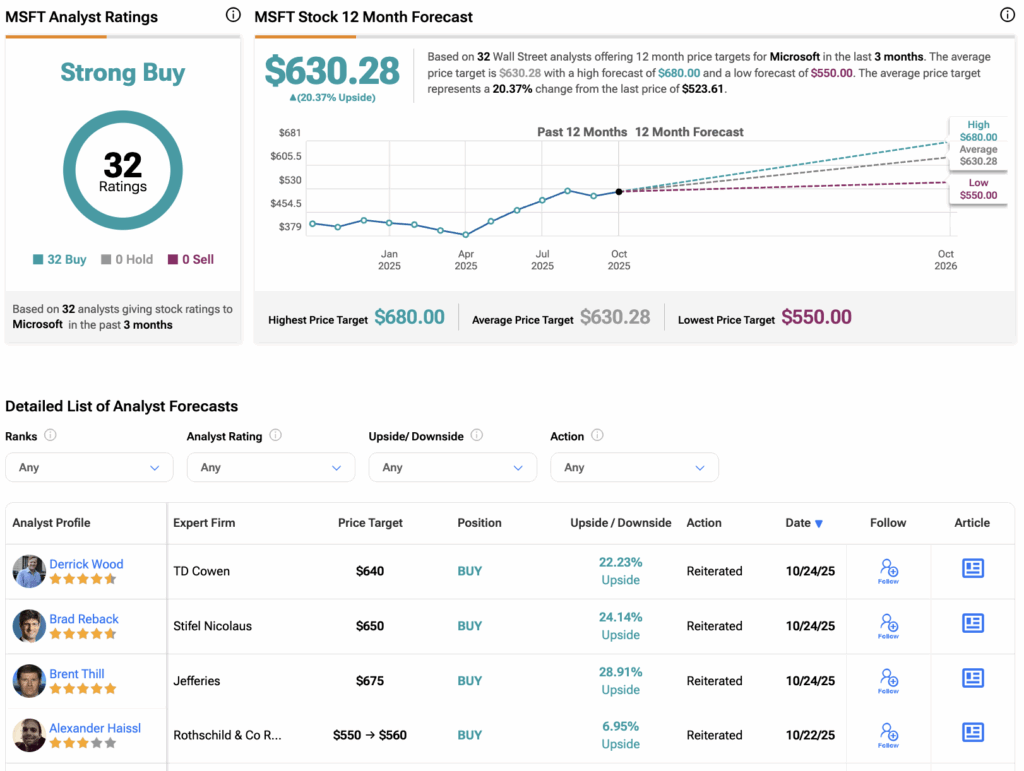

According to TipRanks, MSFT stock has a consensus Strong Buy rating among 32 Wall Street analysts with all Buy recommendations assigned in the last three months. The average Microsoft stock price target of $630.285 implies a 20.4% upside from current levels.