Earnings season will reach a crescendo this week as the world’s biggest companies all step up to the earnings plate. Among them is the newly crowned world’s most valuable company by market cap, Microsoft (NASDAQ:MSFT). In recent times, Microsoft has wrestled that accolade from Apple, as the stock has been rewarded for the company’s positioning at the forefront of the biggest current theme – AI.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, ahead of the tech giant’s F2Q24 results (slated for a release post-close on Tuesday, January 30th), Deutsche Bank’s Brad Zelnick, a 5-star analyst rated in the top 1% of the Street’s stock pros, notes that even amongst its peers, MSFT stock “screens expensively on both absolute and growth adjusted multiples (EV/Sales, P/E and P/FCF).”

Accordingly, Zelnick thinks estimate revisions are what will be needed to power the stock’s performance in 2024. Luckily, the chances of that happening are quite high.

“The good news in our view is that much of the AI excitement that drove last year’s multiple rerating, and what we believe is an improving public cloud backdrop aren’t fully reflected in consensus estimates for M365 or Azure yet,” the top analyst explained. “We see revenue upside in both, which along with greater than anticipated room for margin expansion provides opportunity for the stock to continue working in CY24, in our view.”

As for the results, against a backdrop of Azure optimization activity easing “relative to stable embedded expectations” and Windows likely to experience positive effects from a stabilization in PC demand during the holiday quarter, Zelnick is calling for F2Q revenue of $61.1 billion, a touch higher than the guide’s midpoint but below “historical seasonality.” At the other end of the scale, factoring in a reduction in OpEx and predicting healthy operating margins of 42.5%, Zelnick sees EPS reaching $2.75, although that is still slightly below consensus at $2.78.

Looking further down the line, while Zelnick admits it will take some time for the ramping of AI monetization to make itself truly felt on the company’s $200 billion+ revenue base, he maintains his confidence in Microsoft’s ability to “sustain healthy double-digit FCF growth for years to come and anticipates seeing “tailwinds growing” as the year progresses.

End result, Zelnick reiterated a Buy rating on MSFT shares and pushed his price target up from $415 to $450, implying shares will post growth of 10.5% over the course of the next year. (To watch Zelnick’s track record, click here)

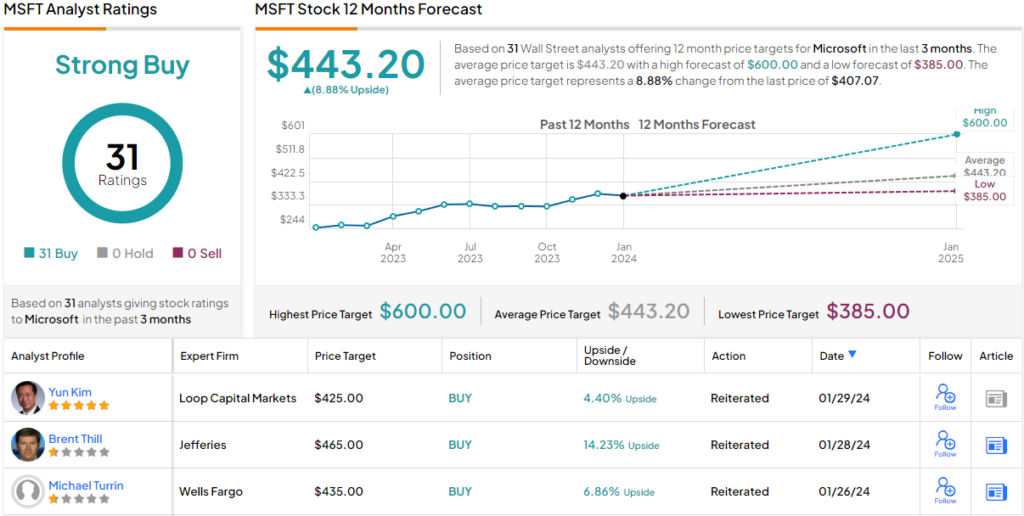

No one on Wall Street is in a mood to argue with that take. All current reviews are positive – 31, in total – naturally coalescing to a Strong Buy consensus rating. Going by the $443.2 average price target, a year from now, shares will be changing hands for ~9% premium. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.