Job cuts have historically done good things for stock prices. Recently, Micron Technology (NASDAQ:MU) recently discovered that pay cuts for executives can help, too, though in a somewhat different direction. Though it’s down a bit going into Friday afternoon trading, Micron landed an upgrade from an unexpected quarter

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Just recently, Micron announced that it was suspending bonuses to its executives. Given how things have been going at Micron of late—not to mention in the wider tech stock sector—this probably shouldn’t have come as a surprise. The firm also planned to cut some salaries on top of its earlier plans to cut 10% of its workforce altogether.

However, immediately following that news came word from Mizuho Securities. Mizuho hiked the rating on Micron stock from “neutral” to Buy. The timing was impressive. However, reports note that the rating hike really didn’t have much to do with the pay cuts and bonus losses. Rather, Mizuho hiked its rating based on the idea that memory chip sales would start making a comeback in the second half of 2023. In that vein, Mizuho also bumped up the ratings on Western Digital (NASDAQ:WDC) and Seagate (NASDAQ:STX). Both jumped from “neutral” to Buy for the same reasons.

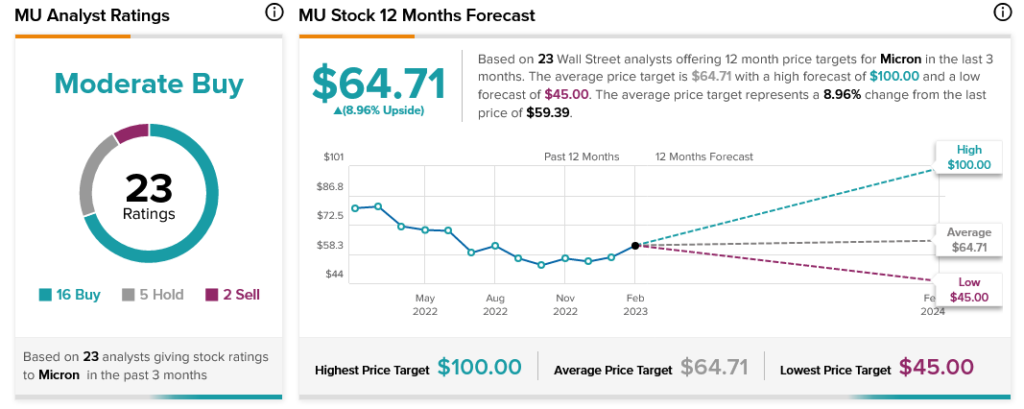

Wall Street, on the whole, is sticking with Micron. Currently, analyst consensus calls Micron stock a Moderate Buy with an average price target of $64.71 per share, giving it 8.96% upside potential.